A few days ago, Revolut, the British fintech, announced the launch of a new feature in its mobile application: Revolut Stays.

A few days ago, Revolut, the British fintech, announced the launch of a new feature in its mobile application: Revolut Stays.

It’s not enough for banks to just release an app. It should be an engaging solution — but how to achieve it?

Launching new functionality requires blood, sweat, tears… and a lot of development. How to make the process simpler?

What is a typical starter pack for any challenger bank? First of all, launch a mobile app, then issue a card, and finally… give it all for free. There is no web app in this formula. Is online service not important any more?

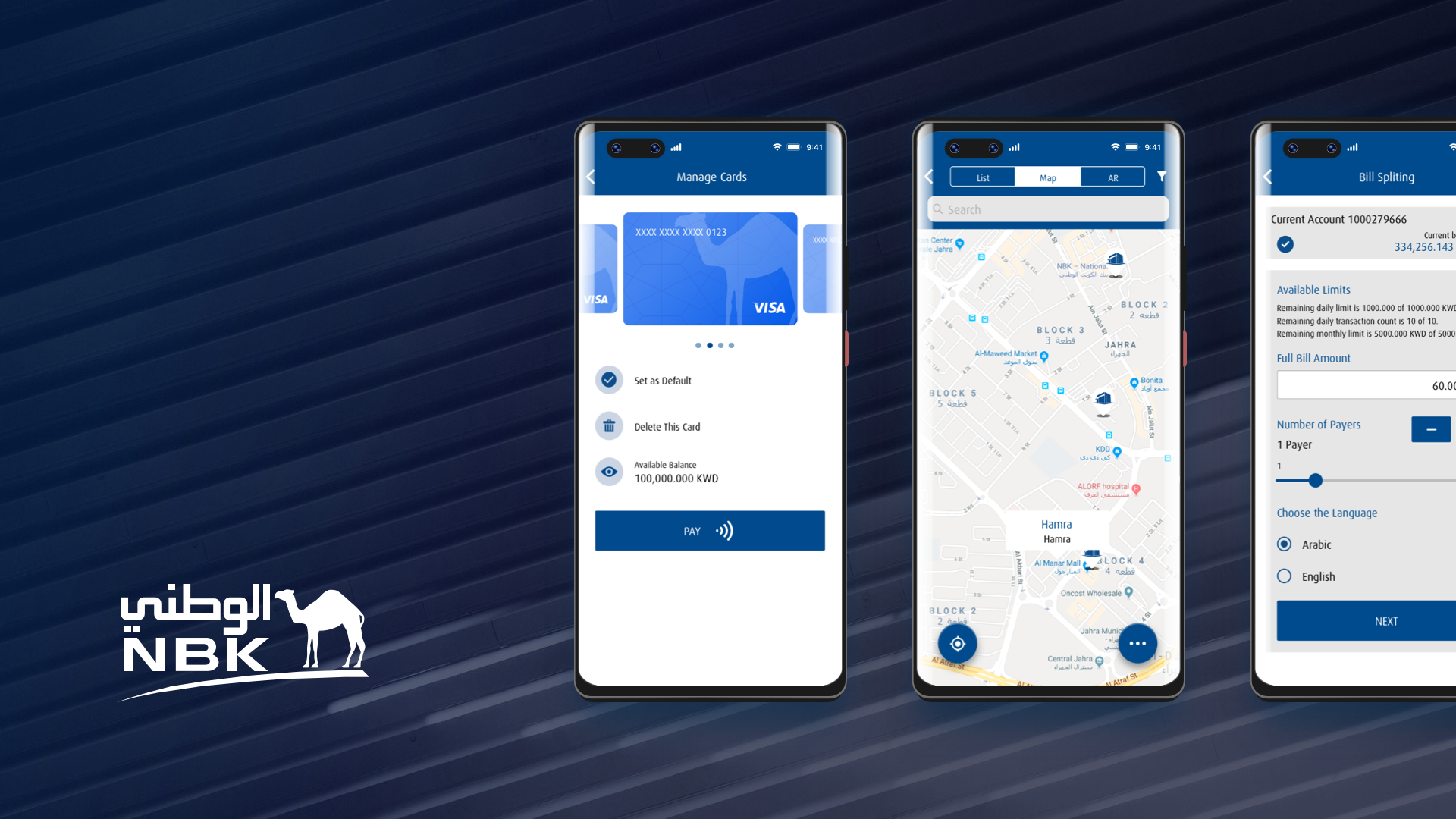

What is the distinguishing quality of the mobile banking app of the National Bank of Kuwait? The fact that it sets new trends in mobile banking, which is only confirmed by the Dark Mode implemented by FINANTEQ.

With the OCR technology, customers of Credit Agricole can now pay invoices and bills more easily than ever before.

Is it easier to open an account with one of the challenger banks? Maybe, but the number of clicks isn’t the best way to measure it.

Receive our analysis about innovations from the world of mobile banking and mobile fintech. We will only send one message a month.