Our solution is developed continuously since 2007. Through the years, our application core has been tested in different projects and with different clients. Today it can be used to build stable, secure and reliable solutions for corporate clients.

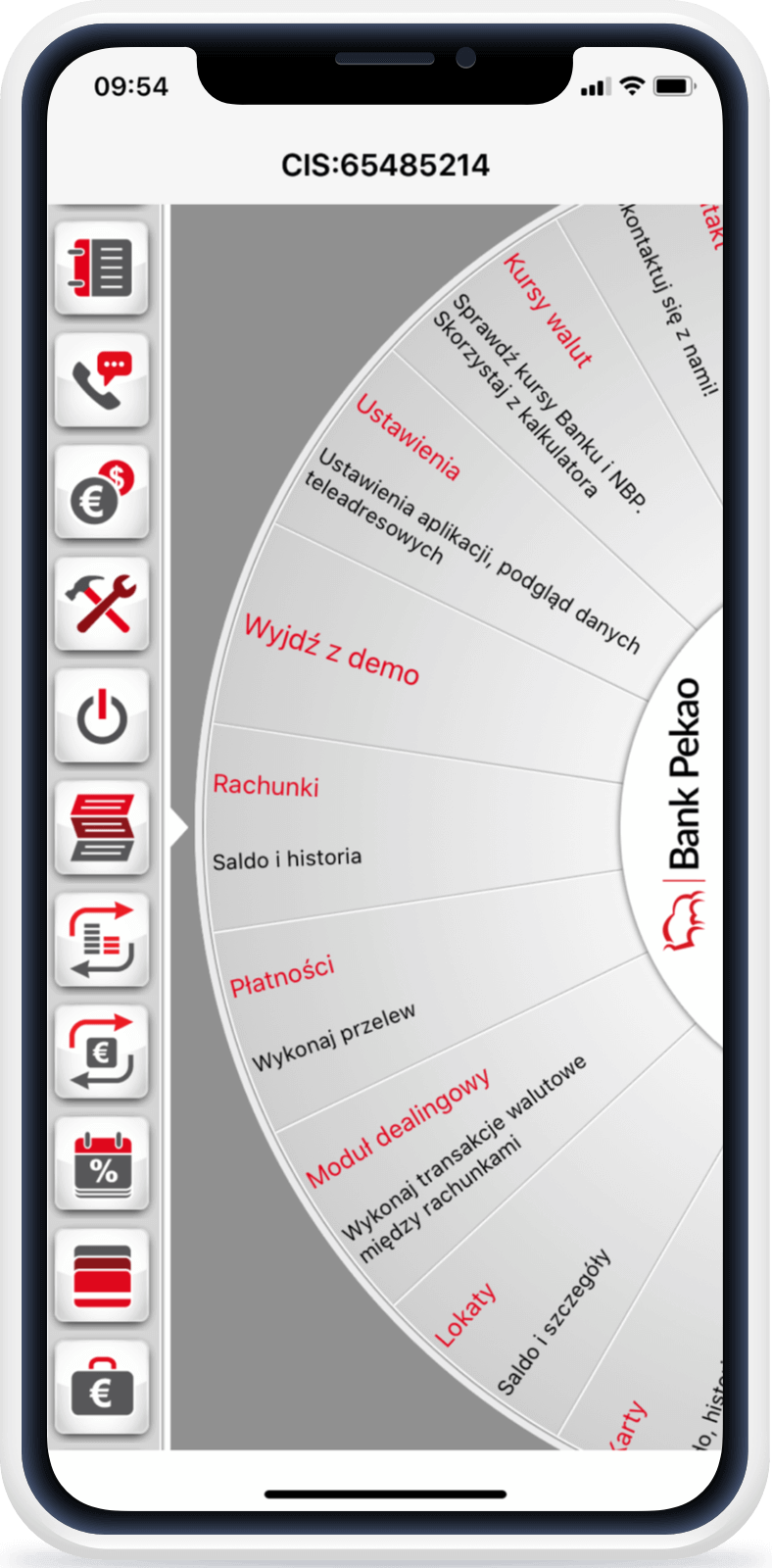

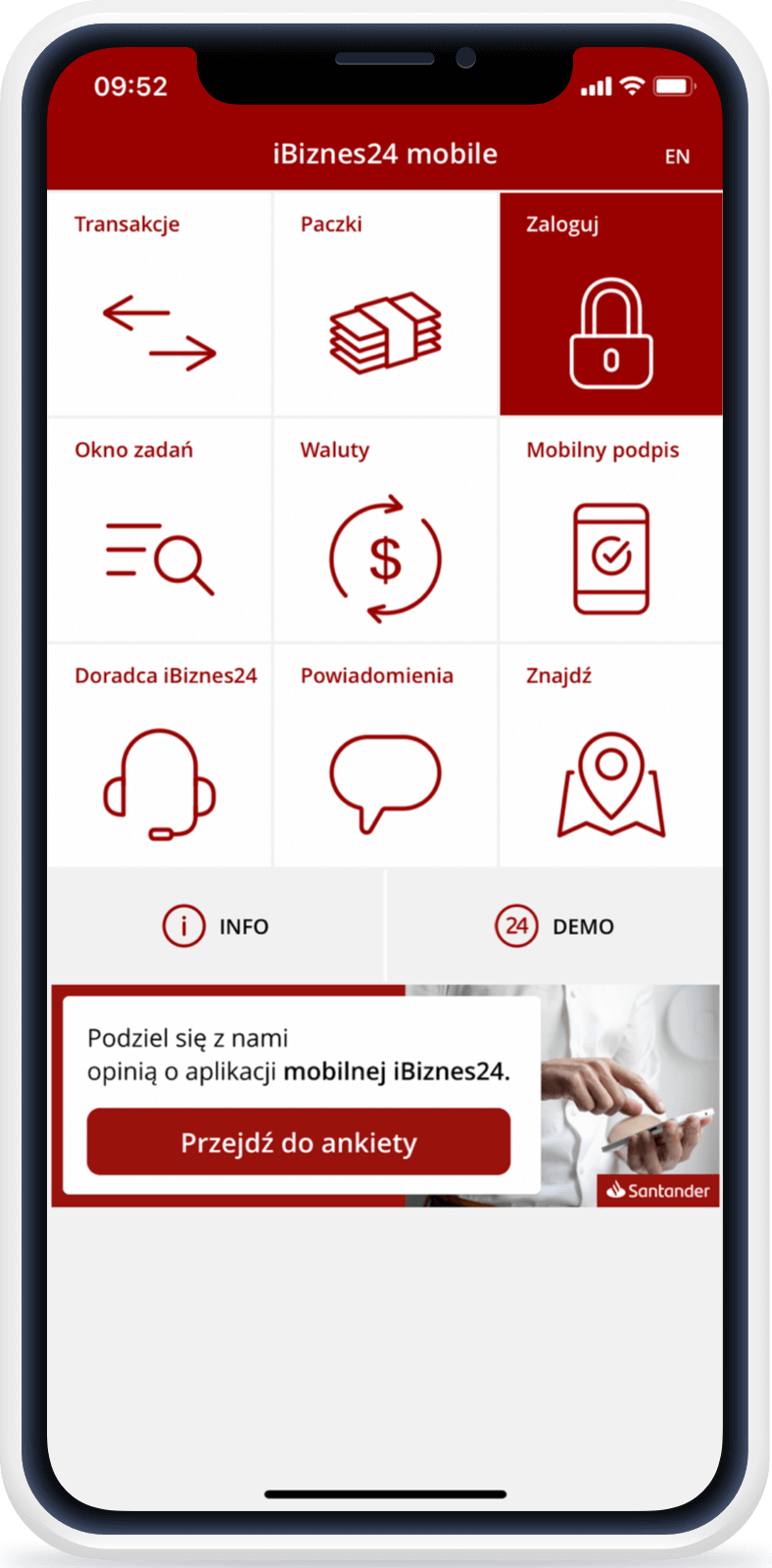

Corporate mobile banking tailored to your customer

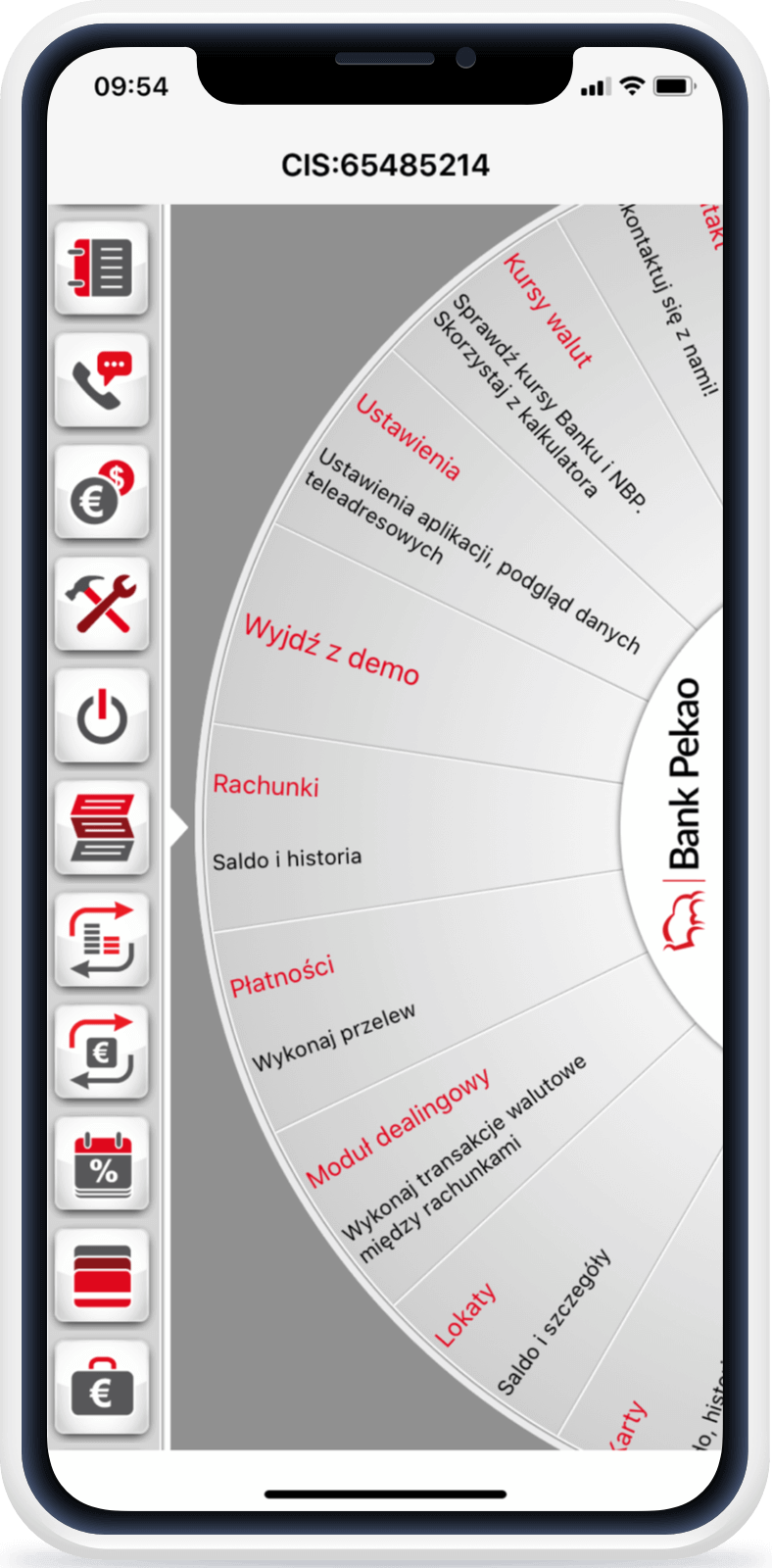

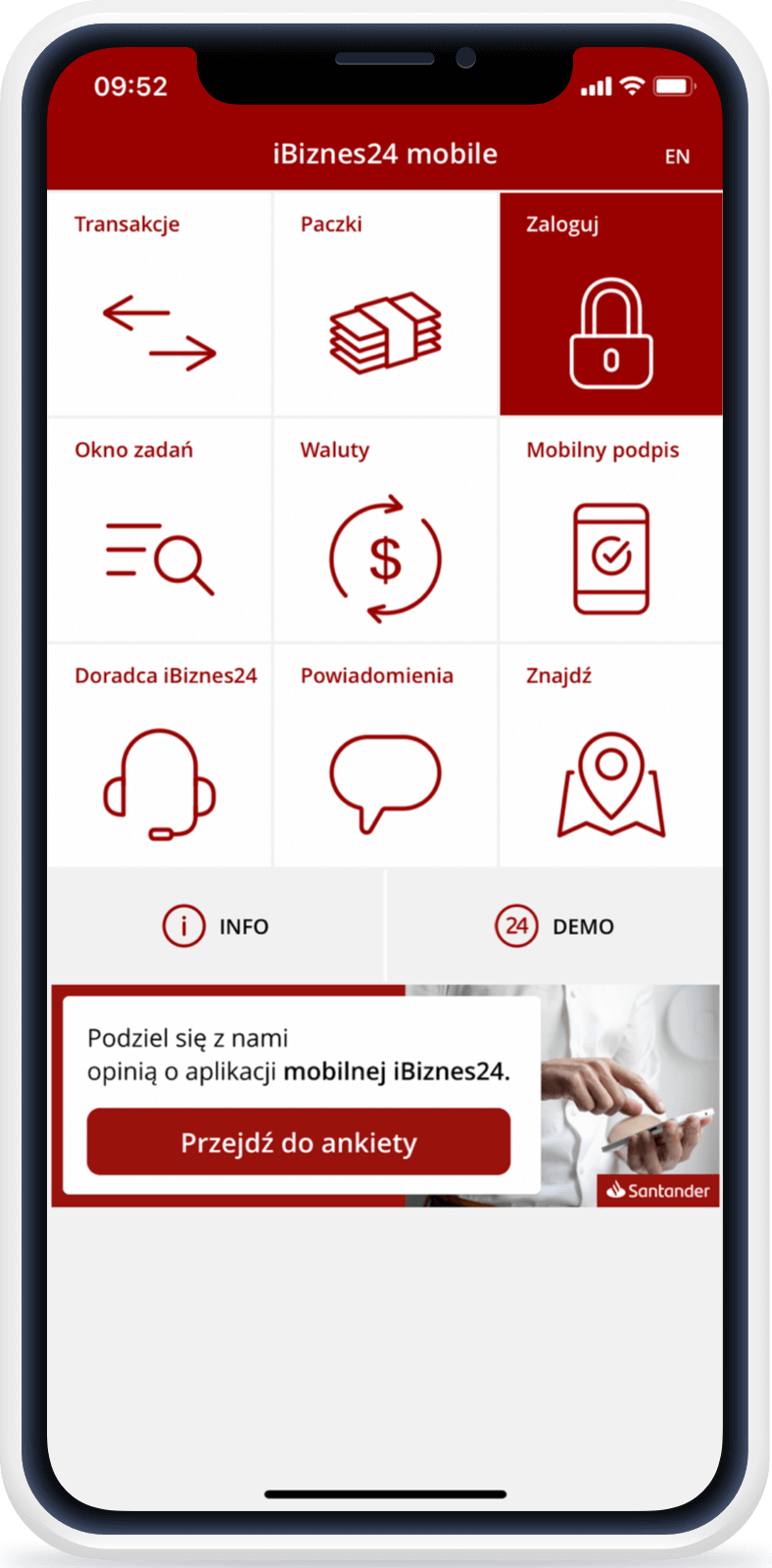

The insurance company differs from the oil company. The car manufacturer has different needs than government administration. Every industry has unique requirements. This is why we customize every corporate mobile banking solution in accordance to our clients’ needs.

Our solution is developed continuously since 2007. Through the years, our application core has been tested in different projects and with different clients. Today it can be used to build stable, secure and reliable solutions for corporate clients.

We offer one of the widest ranges of security mechanisms on the market. This includes application shielding, antivirus, certification mechanisms, token, HTTPS encryption and an additional original encryption mechanism as well as obfuscation. More information here

Our mobile applications for retail banking are well known for their innovation. They won many awards in prestigious contests (e.g. Finovate New York or Citi Mobile Challenge) We inspire our corporate clients with the same approach we use in our retail banking.

Our FINANTEQ Insights department will provide you with market research and actionable insights that will help you make the right decisions on how to make your mobile banking solution for corporate clients innovative and up to date. Learn more

With some of our clients we have been cooperating for over a decade now. We created their first mobile banking applications, and to this day we are responsible for making them the next big thing.

Our Mobile Banking Platform can be easily expanded with components when needed. FINANTEQ’s products like SuperWallet, Pocket Branch, Mobile Token, Smartwatch Starter Kit will take your app to the next level.

Although the set of functionality varies depending on the bank’s requirements, here are some of the most popular features.

gives a designated person ability to accept transfer sets or individual transfers.

acceptance structure tailored to the client's needs.

lets your client to find desired data quickly thanks to an extensive search system.

aggregated view of company’s financial health or international market situation.

a wide range of options for granting rights to system users.

We create solutions for Mobile and Internet Banking experience. Both front-ends are integrated through middle ware layer and can be deployed as one large solution.