What is the distinguishing quality of the mobile banking app of the National Bank of Kuwait? The fact that it sets new trends in mobile banking, which is only confirmed by the Dark Mode implemented by FINANTEQ.

NBK and Finanteq cooperation

Our cooperation with the National Bank of Kuwait (from now on abbreviated to NBK) dates back to 2011, when mobile banking was still in its infancy.

The NBK mobile app has come a long way — says Leszek Piątek, Senior Project Manager at FINANTEQ. — Users came before Android popularity – we started with iOS and Blackberry. Currently, it gives users access to all necessary functions of modern financial management, becoming the main banking channel. Customers also receive a number of features available only in the mobile channel, such as Dark Mode. At FINANTEQ we are currently working on developing further solutions – it guarantees that the app will be unique not only for Kuwait.

For all those years, the main goal of the FINANTEQ team remained the same. The key objective has been to provide NBK with a mobile application that would include the bank’s wide range of products and services, and meet the needs of its customers. Over the years, the application evolved. It was expanded to support smartwatches and new features were added at a very impressive rate.

For all those years, the main goal of the FINANTEQ team remained the same. The key objective has been to provide NBK with a mobile application that would include the bank’s wide range of products and services, and meet the needs of its customers. Over the years, the application evolved. It was expanded to support smartwatches and new features were added at a very impressive rate.

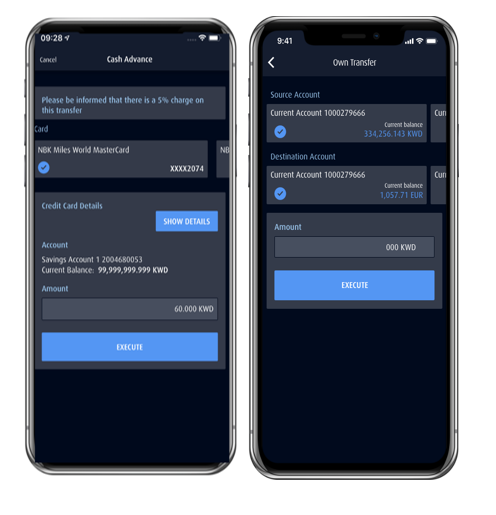

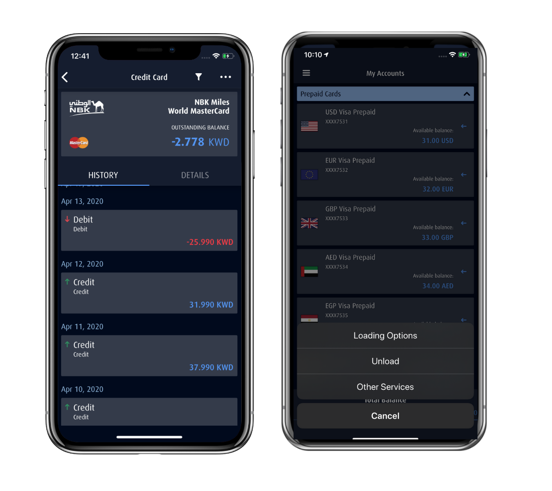

The application of National Bank of Kuwait – the standard view

The application of National Bank of Kuwait – the standard view

The application has been updated continuously and provides its customers a secure way to perform transactions, open accounts, increase credit card limits and check the number of NBK miles as well as NBK bonus points.

We want our clients to set new trends in mobile banking, so that they can offer the users of their mobile banking app superior quality and the most up-to-date solution. This is how the idea for the Dark Mode, another feature of the NBK’s app, was conceived.

Why Dark Mode?

The Dark Mode was our collective idea. Both NBK and FINANTEQ sought to implement a new functionality that would reflect two important aspects of the NBK’s strategy —sustainable development of mobile banking and social responsibility of the business.

In an effort to provide a comprehensive and convenient banking experience to our customers and to maintain our leadership position in the sector, we continue our effort to offer comfort to our customers ensuring they benefit from our digital solutions and banking services aligned with our Digital Transformation Strategy. For that purpose we closely follow up latest innovation trends and provide new innovative services to our customers. — says Mohammed Al-Othman, General Manager, Consumer Banking Group at the National Bank of Kuwait.

The rank of mobile channel

NBK’s mission is to responsibly offer innovative financial solutions. That is why the bank offers the best mobile banking application for business in Kuwait in its class, with over a hundred thousand downloads to date. Its innovation has been validated by such awards as last year’s “Best in Mobile Banking” granted by Global Finance.

“Mobile Banking First is a key strategy for the bank. We want to provide all services and products online using the mobile banking app — says Dimitrios Kokosioulis, Deputy CEO, Group Head of Operations & IT at the National Bank of Kuwait.

Social responsibility of business

Commitment to corporate social responsibility is also an integral part of the NBK’s development strategy. NBK strives not only to provide the best digital solutions and banking services but also a comprehensive banking experience that takes into account the health of our customer by ensuring our services are easy and convenient to use. This comes as part of NBK’s sustainability strategy where customer service is one of the key pillars of this strategy — says Cigdem Iltemir Carino, Consumer Banking Group Head of Digital Transformation at the National Bank of Kuwait

What does the above have to do with the Dark Mode?

Dark Mode is the new black

How does the Dark Mode fit into the social responsibility strategy? A dark user interface is already available in numerous applications (like Facebook and Instagram), as well as operating systems such as Android and IOS. A feature which virtually became a must in 2019 is not a modern “invention” at all. Just try to recall the first computers —equipped with monochrome CRT monitors, which displayed greenish text on a black screen.

The implementation of the Dark Mode in the NBK app brings two substantial benefits. First, the use of a dark interface decreases the power consumption of the display by 10 to 50% on average, compared to applications with a bright user interface (as proven by Google).

Second big benefit of the Dark Mode is significantly less eye fatigue when using this application in the evening and at night. Dark Mode reduces the contrast between the dark background and the bright screen of the smartphone and decreases the emission of blue light. The content displayed is therefore more legible, which significantly improves the comfort of prolonged screen use in low light conditions. It is worth adding that blue light has a negative effect on the secretion of melatonin, a hormone that causes sleepiness. Limiting blue light exposure is important for people who experience difficulties with falling asleep.

The Dark Mode has an impact on UX as well. It just looks more elegant. While the majority of applications have a similar white display mode, the dark mode offers a more toned down and exclusive look.

How was the implementation of the Dark Mode conducted at NBK?

At FINANTEQ we made every effort to provide the bank’s customers with an innovative technology for both Android and iOS platforms, which they could enjoy ahead of others.

The introduction of the Dark Mode in the NBK app was an intensive and very creative time — says Inga Rokicka, Customer Relationship Manager at FINANTEQ. — At every stage of the project we were in touch with the bank and received the necessary support to secure a swift and trouble-free deployment. We are extremely proud of the effect, but first of all, of the cooperation with the bank, whose priority is to deliver highest quality and exceptional user experience to its customers. These are also the key points of FINANTEQ’s mission.

We designed an elegant interface where all features of the application remain fully coherent and automatically adjust to the currently selected mode. This is particularly important to the users, as they do not have to change their habits and learn the application anew. Moreover, they can choose freely the preferred view (switching between bright, dark and automatic).

NBK is one of the first banks to have introduced the Dark Mode. This development meant not only a desire to adapt to a new trend, but, above all, a step towards helping users. The bank cares for their health and enables them to adjust the look of the application to their needs.

We are delighted to have been involved in this project and pleased that we, FINANTEQ, had the opportunity to guide the National Bank of Kuwait to the “dark side” of… the app.