Are you planning to develop a mobile banking app for your customers? Or maybe you are thinking about revamping the existing one? All you need to do is find the right company to carry out the project!

Are you planning to develop a mobile banking app for your customers? Or maybe you are thinking about revamping the existing one? All you need to do is find the right company to carry out the project!

Today, the financial sector remains one of the most popular targets for hackers. At Finanteq, we know that the highest security level in mobile banking apps is a must. We know how to write code and what security features to use to make banking applications unbreakable.

We love to share good news, especially news concerning prestigious awards. We are pleased to announce that we have been named a 2023 Forbes Diamond.

How to stop chasing customers’ expectations and focus on getting ahead of them? Choose the right software provider – this is one of the key decisions for any business for which remote channels are critical.

What is the most crucial factor determining a company’s competitiveness and bottom line? A perfect product, a favourable price, a great location, a friendly staff, or an intuitive and easy-to-navigate mobile app?

Not anymore!

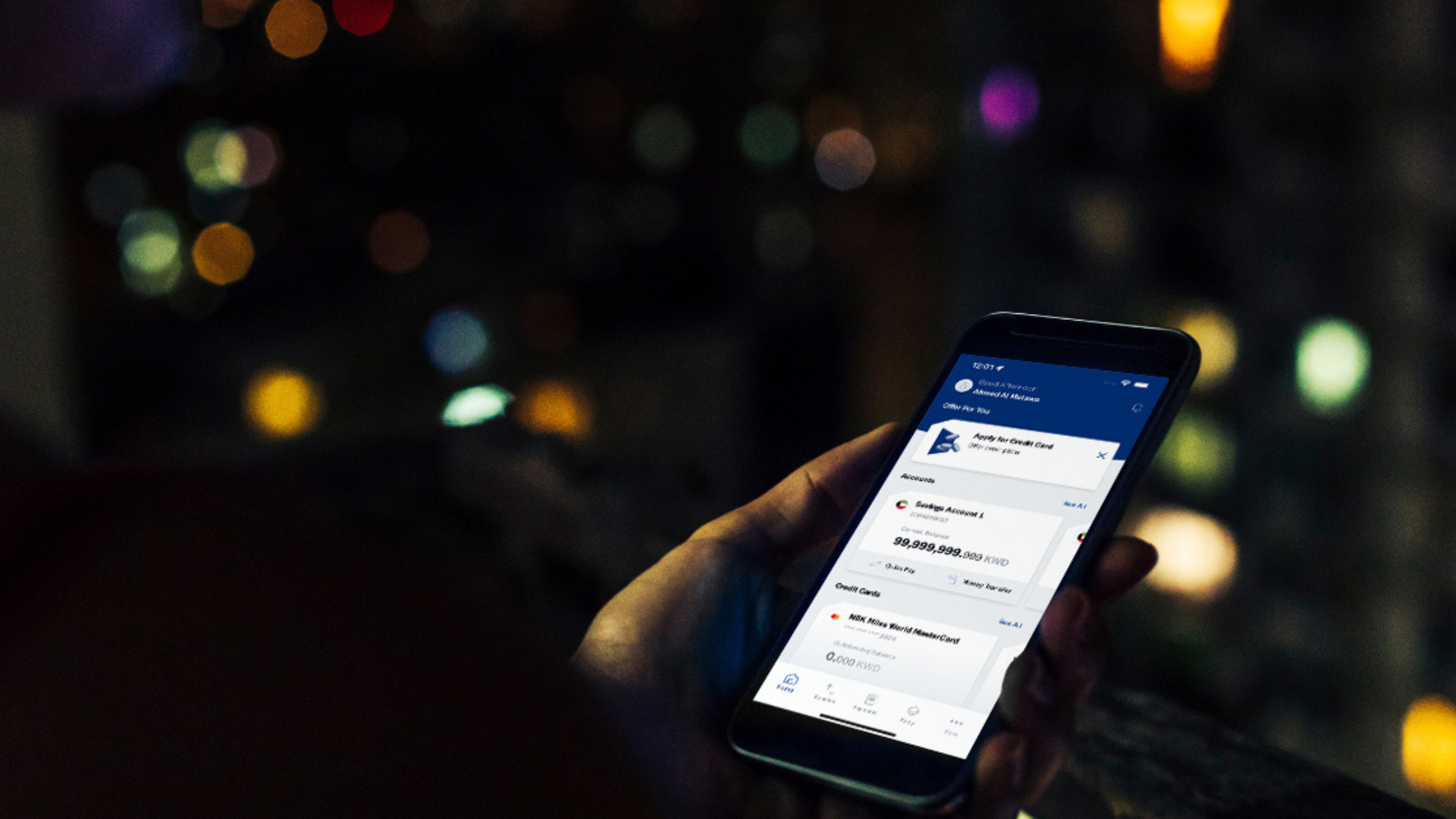

Modern online banking users expect more and more improvements. They also look forward to receiving excellent service. What is more, the number of customers that handle their financial tasks fully remotely is increasing.

Did you know that at Finanteq, we made the first banking applications even before the iPhone and Android era? It was a time when there was yet to be anyone who believed in apps. Mobile browsers were still commonly considered the future of banking.

Receive our analysis about innovations from the world of mobile banking and mobile fintech. We will only send one message a month.