What is the most crucial factor determining a company’s competitiveness and bottom line? A perfect product, a favourable price, a great location, a friendly staff, or an intuitive and easy-to-navigate mobile app?

Not anymore!

For some time, this factor has been the customer experience (CX) – especially in the financial industry.

What is customer experience in banking?

Customer experience in banking refers to the overall customer experience in all sales channels (both online and offline) over the entire relationship period with the bank.

Does customer experience matter?

In Statista research, 94% of responding customers stated that a positive customer service experience made them more likely to purchase again, and 82% of customers would recommend a company based solely on excellent customer service.

At the same time, two third of consumers say most companies they do business with should improve their customer experience (Broadridge research). A lack of attention to a positive experience can contribute to customers’ dissatisfaction and, ultimately, their looking for a better offer and moving to competitors.

Digitization of customer experience

Digital transformation driven by changing customer expectations forces companies to adapt to new market realities and remodel their business strategies.

There is no digital transformation without a customer experience transformation, which means enhancing processes and touchpoints to improve how customers interact with a company.

As the research confirms, 35% of companies say digital transformation is helping them to meet customer expectations better and improve operational efficiency (40%), and 38% of companies plan to invest more in technology to make it their competitive advantage.

Almost half of all organisations report customer experience and satisfaction as the main factors influencing their decision to go for digital transformation. More than 70% of senior banking executives rank CX as a top priority (Digital Banking Report).

Digital customer experience includes all customer interactions with a brand online using digital technology.

To deliver a better financial services customer experience, it is necessary first to understand who the new type of digital customer is and take a more in-depth look at their current products and services to determine if there is an opportunity to provide a greater degree of customer focus and personalization.

Banking innovation ideas

Unlimited availability, maximum convenience, simplicity, intuitiveness, accessibility or quick service are no longer the only determinants influencing their experience.

Delivering a great experience in the digital era requires entering the next level of transforming that experience. While improving sales and service processes by digitising them, it cannot be forgotten that the most important is the customer and their needs.

The new level of customer experience is based on relations and creating positive change in their financial objectives and life journey. The customer experience is becoming a strategic part of brand building in many companies – focusing on customers and adopting a more customer-centric strategy is the key.

When it comes to digital experience improvement, implementing relevant, innovative ideas is essential to maximise digital customer engagement.

And now it’s time to take the next step: using technology to provide the customer with not only access to products and services through remote channels but also an unparalleled, superb experience.

As consumers look for more engaging ways to interact with their financial institutions, keeping customer satisfaction in mind, banks should respond to these needs. Some ready-to-use fintech solutions may definitely contribute to this.

If so, let’s look at what banks can do to improve the customer experience.

Trends in retail banking

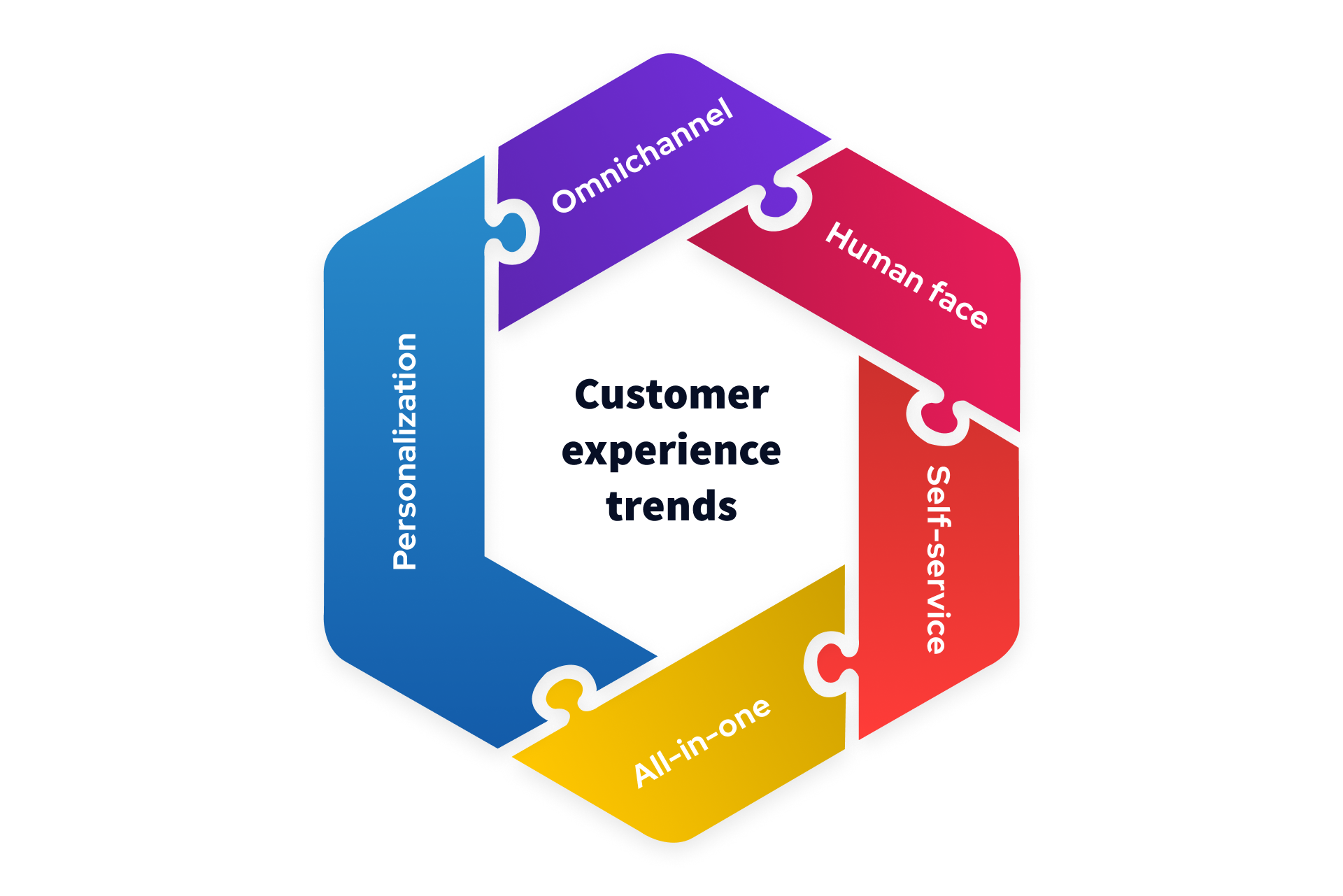

Human face of remote solutions

Trends confirm: customers already expect more than just remote access to products and services.

Virtual assistance, of course, matters, but well-designed digital experiences should provide more: a similar experience to what customers know from branch service.

New ways of remote communication with customers should also include a different level than before: the human level.

Implementing virtual branches (like Finanteq’s Pocket Branch) seems to be the perfect option here.

Video connection ensures direct, face-to-face contact. When dealing with complex financial products, it is essential as it facilitates relationship building and provides a sense of comfort and security, translating into a better digital banking customer experience.

Omnichannel customer experience

Multiple contact channels (e.g. websites, mobile apps, branches or call centres) are no longer exceptional, although only some banks provide this.

Depending on their possibilities and needs, customers want their bank to let them choose their path to purchase and being served (multi-channel experience). Having the choice to interact with the bank in a preferred way improves CX and is part of an overall omnichannel experience.

Moreover, the latest research shows that 69% of customers want a consistent experience with a company across all physical and digital channels. Although they may accept different levels of service in different channels, they expect the same quality of communication and transparency of information. It is known as the omnichannel experience.

Engaging customers by providing a seamless experience on all platforms is the core of omnichannel strategies.

How to delight customers with a smooth and enjoyable experience?

How to ensure a consistent experience across all online and offline channels?

The omnichannel experience demands synchronisation of the data between channels and continuity. A single digital profile should be created every time a user interacts with a bank. Observing the customer experience is essential: the next time the customer contacts again, their journey should start from where they stopped last time.

By providing the customer with access to service in their preferred form and at a similar level across all channels, Finanteq’s Pocket Branch:

- Fits perfectly with the multi-channel experience – it provides customers with three additional remote contact channels: video, audio or text chat (moreover, the tool can be implemented as a standalone solution or embedded into any mobile application or website).

- Provides continuity of service by enabling the user to switch from one medium to another during a conversation (e.g. from an audio to a video call), which fits in with the idea of the omnichannel experience.

Personalising the experience

Delivering personalised experiences is nothing new in the banking industry, but today customers expect more. Personalisation is a factor that hugely determines how they evaluate their customer experience.

While offering a variety of options to the customer is standard, it is also essential to remember that, increasingly, the deciding factor for a high rating of one’s experience is the extent to which these proposals match needs and expectations. Not every customer expects the same things. And today, they expect a personalised approach. Today’s buyers want organisations to treat them as unique individuals and to know their personal preferences and purchase history.

How do ready-to-use solutions respond to the need for personalisation?

-

No-code platform in banking experience personalization

Can low-code/no-code tools help personalise the customer experience?

At Finanteq, we do not doubt that it can, which is why we have designed Extentum, a tool that extends existing mobile and web banking applications.

With Extentum it is possible to build and launch scenarios tailored to customers’ needs.

A scenario can be run as a survey, tutorial or conversation. The start of each scenario is a message displayed on any screen of the app, encouraging users to interact (known as an ‘engager’).

Extentum is a great tool when it comes to personalising the experience, as it enables:

- Customising the scenarios displayed to a customer/group of customers depending on their needs. Based on the information on customer behaviour, Extentum enables building scenarios which, for example, facilitate the completion of banking operations.

- Creating and launching scenarios, functions and redirections to specific functions for specific customer segments (for example, VIP customers). This means that while all customers can use the same mobile application, with Extentum, the application can be personalised for a specific group of customers.

For more information on Extentum’s capabilities, see our Product Overview.

-

Increasing banking customer experience personalization with Pocket Branch

Finanteq’s Pocket Branch – a chat, audio and video banking in one solution, offers a bunch of tools which contribute to excellent customer experience in the area of personalization, which are:

- Video call option – during this type of connection, both sides can see each other, allowing contact in a form as similar as possible to a branch visit.

- Sales tools (screen sharing, drawing board, sending documents and banners) – allow tailoring communication to the situation and the customer’s needs. The advisor may use visual tools or show simulations or presentations to explain the product visually here and now, which builds trust and credibility and reduces customer effort.

- VIP queue managing, which enables providing priority service to a selected group of customers (by assigned personal advisers). It enhances a sense of prestige and improves user experience.

- Proactive chat – after prior synchronization with Extentum, it is possible to display the chat window to the customer precisely when they are in doubt. This a fantastic example of experience personalization!

Learn more from our Pocket Branch Product Overview.

Encouraging and supporting self-service

In a digital world where customers are becoming increasingly self-reliant, getting help from an advisor in a troublesome situation is readily available – banks usually offer a helpline or chat facility.

This is what Pocket Branch is about:

- Firstly, thanks to the proactive chat option I mentioned above, a chat window will pop up at certain moments.

- What’s more, at any time, the customer can use Pocket Branch to contact an advisor via chat, audio or video.

To help customers solve the problem themselves to reduce their effort and thus improve their overall experience, banks can also use the capabilities of our no-code Extentum platform, which offers the possibility of providing the client with tutorials or redirections between screens, which, at challenging moments, will help the client to go through the process effortlessly without the need to contact an advisor.

It is worth mentioning that Extentum enables the creation, launching and testing of different solutions, each time without involving developers and without the need to release a new version of the application.

To conclude, solutions such as Pocket Branch and Extentum are complimentary and allow them to maximise the customer experience.

“All in one” experience

-

All services in one place – super apps

How to make the banking app even more convenient and attractive and improve the customer experience even more at the same time?

Turn it into a super app that allows customers not only to do their banking affairs but also to purchase non-banking products and lifestyle services.

Prompt and simple online shopping is the standard today. The number and value of m-commerce transactions are growing yearly, but not as many banks offer customers shopping in a banking app.

Our SuperWallet breaks new ground for banks.

By providing customers with m-commerce services (VAS) within a banking application, the customer does not need to install several applications to order a taxi, pay for parking or book a hotel. They have access to multiple lifestyle services within a single banking application.

What could be more convenient and engaging at the same time?

-

A single device with new capabilities – wearables disruption

You may have one app on your smartphone or… you can take your banking everywhere with Finanteq’s Smartwatch solution.

The Internet of Things (IoT) market is growing. Smartwatch banking is still a niche – offering the ability to bank via watch is already a significant differentiator from the competition.

If carrying only a watch, your customers can easily withdraw money from an ATM, pay contactless for purchases, make a quick transfer and more.

Summary

In the long term, the power of the customer experience is priceless. A seamless customer experience can be worth at least as much as an excellent product or efficient process.

Customer experience is now a critical competitive differentiator in the banking industry, and for a good reason: financial institutions that invest in customer experience in banking have higher recommendation rates, a higher share of wallet and are more likely to sell products and services to existing customers.

All the tools and solutions described above allow the creation of new processes using state-of-the-art technology. If your bank is looking for solutions to facilitate customer experience transformation and improve the customer experience – please contact us.

Let’s talk and choose the best solutions to enhance your bank customer experience.