What is a typical starter pack for any challenger bank? First of all, launch a mobile app, then issue a card, and finally… give it all for free. There is no web app in this formula. Is online service not important any more?

What is a typical starter pack for any challenger bank? First of all, launch a mobile app, then issue a card, and finally… give it all for free. There is no web app in this formula. Is online service not important any more?

Is it easier to open an account with one of the challenger banks? Maybe, but the number of clicks isn’t the best way to measure it.

YouTube was a dating site, and Slack was supposed to be a game. Can banks change their business models the way startups do?

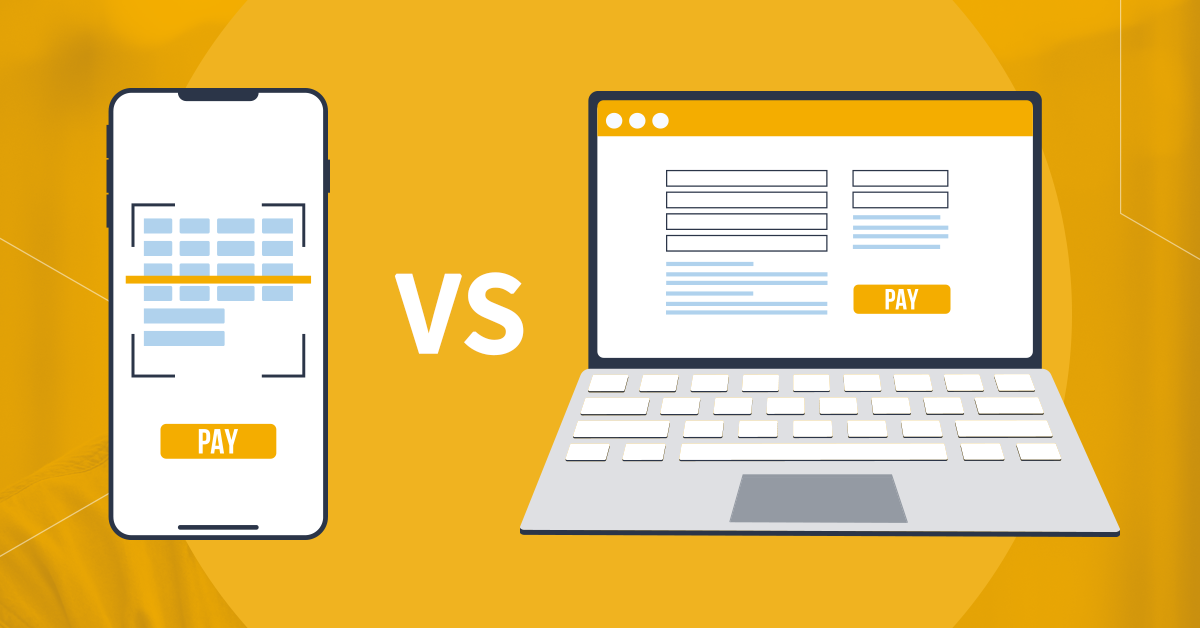

Despite the dynamic development of mobile banking apps, users still prefer to pay their invoices using a computer. How to automate invoice payments in mobile banking?

From tracking the card location to “drunk mode” — banks can use all sorts of ways to protect the customer’s payments. All thanks to mobile apps.

Is it possible to fill the whole page with just one sentence? A friend once told me that during his days at university, one of his law professors was doing just that — he used only a few sentences to write an entire book

Can you imagine? Learning law is hard. Decoding a thought behind an endless sentence must be a torture.

Receive our analysis about innovations from the world of mobile banking and mobile fintech. We will only send one message a month.