The rise of technology and changing customer behaviour have shaped the banking landscape in recent years. These challenges, and the accelerating pace of change, are forcing the industry to redefine its approach to customer relationship management in a new digital reality.

Understanding the digital-first banking transformation

What is digital transformation?

Digital transformation is adopting digital technology in all areas of a company’s activities. It affects the way a company operates and the value it delivers to its customers.

On the one hand, digitalization refers to the widespread deployment of technology in business, e.g. websites, e-commerce, mobile applications, cloud solutions, automation, artificial intelligence (AI), and machine learning (ML).

On the other hand, it relates to how the technologies are used and the purpose for which the company implements them, e.g. improving operational efficiency or customer engagement.

Why are companies going through a digital transformation?

In general, businesses are making changes mainly for two reasons: to meet changing customer needs and to stay competitive in the market (ultimately, of course, to increase revenues).

In recent years, in a rapidly changing reality, the main driver of change and the implementation of a digital transformation strategy is customers and their changing expectations (this is admitted by almost half of all organizations). Customer satisfaction is the goal. After all, customers keep businesses going, so keeping them happy is key.

The digitalization trend is nothing new – we’ve been seeing it in business for a long time. However, there’s no denying that it’s only the corona crisis that has dramatically accelerated the pace of change and put digital transformation as the number one goal for most businesses.

In a Deloitte survey (“Crisis as catalyst: Accelerating transformation”), more than a third of respondents admitted that digital transformation in their companies was a response to the crisis. Only a quarter of organizations started it before the pandemic erupted.

According to statistics, 97% of executives say that the COVID-19 pandemic sped up digital transformation efforts, and 79% of companies admit that the pandemic increased the budget for digital transformation.

Digital transformation in banking and financial services

The pandemic has also changed banks, which have begun to deploy new digital technologies to an ever-increasing degree to reach out to their customers, introduce new remote forms of contact, start offering more services/products via the website and mobile apps, and provide new functionalities fully remotely, basically on demand.

Why digital-first? Exploring the advantages of a digital-first approach in banking

The digital-first strategy enables financial institutions to translate the potential of the digital world into their operating model and then into business benefits. In banking, the digital-first approach is based on customer interaction with the bank mainly through digital channels (website, mobile banking app).

Today, businesses are dealing with a new kind of modern buyer: one aware of the possibilities offered by technology and who expects to be offered the solutions they need here and now. When choosing a bank, consumers today often consider other customers’ evaluation of the organisation regarding their experience with digital channels: everything is supposed to be accessible, fast and convenient.

Since the customer now dictates the terms, more organisations are putting the customer first. And with customers using more digital channels than ever, the customer-first approach must also be digital-first.

Moreover, many banks that have not been as digitally engaged until now to survive in the digital race are somehow forced to adapt to the digital-first world.

To sum up, a digital-first approach seems necessary, and this requires rethinking the way banks interact with customers: having a full-scale digital engagement strategy.

Technology is essentially the banks’ ally.

In addition to the most evident benefits, such as efficiency gains and cost reductions, by having a digital-first channel presence, banks can engage customers in more experiences, which promotes customer satisfaction, and an extraordinary experience, while building greater loyalty.

In short, the digital-first approach enables banks to:

- understand the modern customer;

- learn about his needs;

- engage with him;

- meet his expectations through an omnichannel customer experience.

Digital transformation in the financial sector: trends and innovations

When establishing strategies, initiatives and priorities related to digital banking transformation, institutions should consider the following trends, which have been building a picture of the financial world for some time now and will become even more so in the years to come.

Digital-first approach

The migration of customers from brick-and-mortar branches to online and mobile channel banking has challenged banks to develop new operating strategies. The digital-first (and mobile-first) approach is one of the biggest underlying trends for 2023 and beyond.

Digital channels as first choice

As customers’ expectations of digital banking grow, the use of digital channels will continue to increase. While traditional call centres and branches will certainly not disappear completely (and will only change their face), they will certainly decrease in number in favour of service in virtual branches and customers’ self-service via the Internet and mobile applications.

Mobile banking applications still blooming

All statistics confirm that mobile banking apps are growing in popularity, and banks are providing more functionalities in the apps to make handling financial affairs even more convenient, easier and faster. Statista predicts that mobile banking users will reach 1.75 billion by 2024.

Digital-only banks

“Gen Y and gen Z banks”. These banks do not have physical branches and provide services only through digital platforms, so they have lower distribution costs.

Focus on customer experience (CX)

Transforming the customer experience is crucial to digital transformation in financial services. Delivering better, seamless omnichannel experiences requires continuous improvement of processes and systems based on evolving customer needs. Banks will put the customer first and provide personalized solutions based on advanced customer behaviour analytics throughout the customer journey across the digital reality.

No-code/low-code development

Digital competence development is entering the next level. To quickly deliver applications and new functionality and automate workflows, companies increasingly turn to low-code/no-code solutions. Using these types of tools in banking and supplying employees with them enables the development of mobile and web applications without involving developers, speeds up the introduction of new functionalities, and optimizes the cost of software development.

Personalizing products and experiences

Providing customers with the exact solutions they need is a factor that can translate into achieving a competitive advantage in a time of rising customer expectations. Many digital banking tech innovations, especially those based on ML, AI, advanced data analytics and big data, are conducive to building personalized customer experiences.

Artificial intelligence and chatbots

Chatbots, virtual assistants, or digital customer service is a trend that has been gaining popularity for quite some time and will only increase. AI solutions based on customer data and behaviour in the digital world are already being used today to provide personalized, seamless customer experiences.

Automation

Combined with customer expectations, this is a natural direction: customers no longer want to open an account remotely but sign a mortgage contract. Automating time-consuming, repetitive processes and workflows in banks is a must-have. It allows for increasing the efficiency of processes and freeing up employees’ time which they can devote to activities that bring the most value to customers.

Digitization with a human face

In a new financial world, one thing will not change – the need to maintain human contact based on relationships. While automation may make things easier for bank employees, it will never replace the human empathy and emotional intelligence that modern consumers need.

Focus on cybersecurity

As digital banking grows in popularity, cyber security will become even more critical. Banks must invest in increasingly advanced technology to protect customer data and prevent cyber-attacks (biometrics, AI and ML show great potential for use here). The best mobile security solutions mitigate attacks on a bank’s mobile app while reducing the resources involved in securing it. The strongest application security a bank can provide is using Promon (our partner’s) solutions.

Internet of Things (IoT)

Let’s add the IoT to the list of technological game-changers. According to Mordor Intelligence, the IoT technology market value is expected to rise to $1.39 trillion by 2026.

To put it simply, IoT is any physical device connected to the Internet, making our daily lives easier (e.g. intelligent devices for domestic and industrial use, electronics, cars). Why should banks go for IoT? You can read about it in our blog post here.

Blockchain and cryptocurrencies

Decentralized digital currencies (e.g. Bitcoin) are an alternative to traditional banking services.

Blockchain is a distributed ledger technology that provides secure and transparent transactions.

Both of these tech trends have tremendous potential to change the image of banking, enabling transactions to take place faster, cheaper and more securely.

Open Banking

A new era in the financial industry. It allows third-party providers (e.g. other banks, fintechs, payment intermediaries) to access customer data through open APIs. This means that, for example, through their bank’s app, a customer can view their accounts at other banks.

Partnership with fintechs

Solutions provided by fintechs seamlessly fit into banks’ digital-first strategy and help accelerate the transformation.

On the other hand, fintechs, having modern solutions and seeing the opportunity to enter new market areas, are becoming competitors for financial institutions in the battle for customers.

Banks taking advantage of fintechs’ support in the digital transformation process and establishing partnerships with them are trends that will shape the image of the financial industry in the years to come.

If you want to learn more about trends, we looked at this aspect in detail in our latest article What are the banking trends to follow?

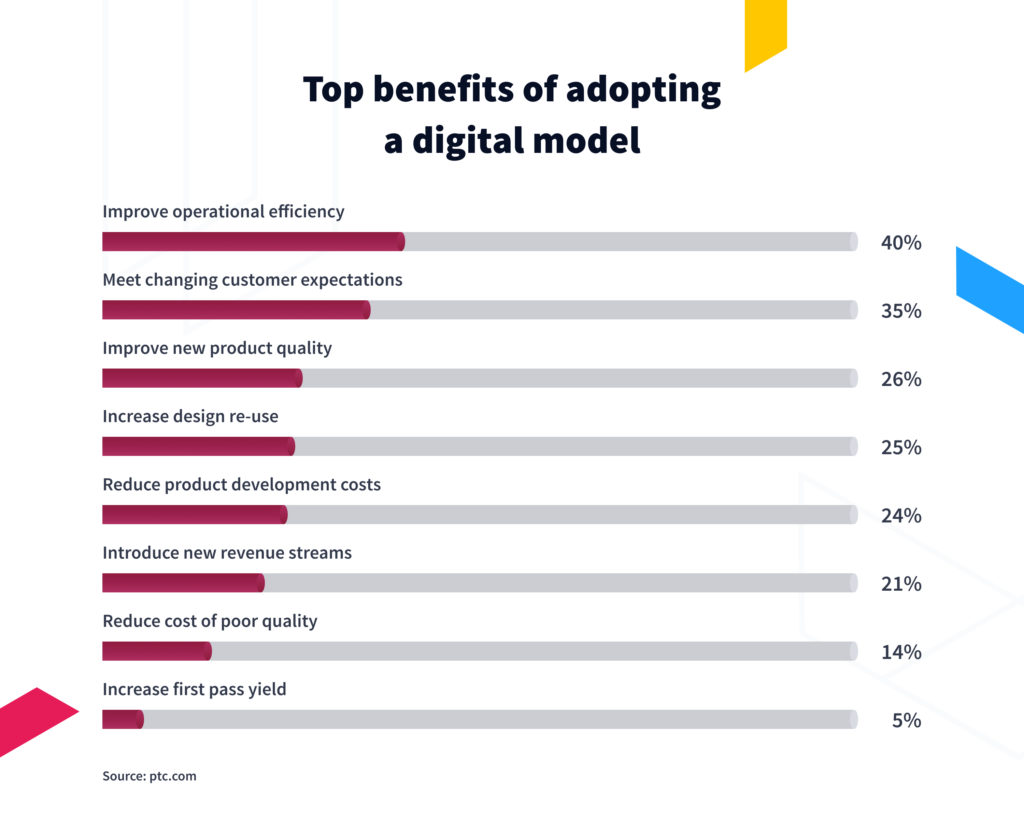

How digital transformation has affected the financial sector? The benefits

Businesses that step onto the path of digital transformation enjoy tangible benefits, such as increased revenue and growth opportunities. Implementing digital solutions not only improves a company’s efficiency but also enhances customer service and makes their bank more innovative in their eyes.

35% of enterprises claim digital transformation helps them meet customers’ needs better and improve their operational efficiency (40%). 38% of companies plan to invest more in tech to make it their competitive advantage.

Below we explain the main reasons banks should invest in digital transformation.

Enhancing customer experience

An exceptional customer experience in the highly competitive banking industry is the key to attracting and retaining customers, building customer loyalty, reducing costs, satisfying employees, and sustainable business growth.

One bank that undertook a customer experience transformation found that the lifetime return of a satisfied customer, willing to recommend the bank to their friends actively, was five to eight times higher than that of a negatively perceived customer.

Why is this happening? First and foremost, digital transformation creates highly engaged customers who:

- are more likely to try a new brand’s product or service;

- are more likely to recommend the brand to their friends and family;

- are engaged and loyal – they can purchase a brand’s service/product even if a competitor offers a better product or price (a seamless customer experience can be as valuable as an excellent product);

- buy 90% more often, spend 60% more per purchase and have three times the annual value than the average customer.

All of Finanteq’s digital solutions foster an improved customer experience. You can read more in my article Enhance the banking customer experience with ready-to-use solutions.

Improve process efficiency and cost reduction

The implementation of digital technologies contributes to the following:

- significant process improvements,

- improving the efficiency and effectiveness of processes,

- substantial cost reduction.

Examples of such solutions include no-code/low-code platforms, for instance, Finanteq’s Extentum, created for rapid mobile banking development by non-developers while reducing the time and cost of the overall process.

What’s more – Extentum’s capabilities are also conducive to improving the customer experience. Since it takes the bank a few clicks to introduce new functionality in a banking application, customers get the expected solutions on the fly.

Another example is optical character recognition (OCR) solutions. On the one hand, facilitating the process improves the user experience, and on the other hand, reduces the cost of complaints (see: Three use cases of OCR technology that improve User Experience in mobile banking app).

Banks also undoubtedly save costs by moving much of their service from brick-and-mortar branches to digital ones – through new remote forms of contact such as Finanteq’s virtual branch, Pocket Branch. Why are remote branches the future of banking? Read more here.

Increasing sales opportunities

By using new technologies, companies can be accessible and reach out to customers and optimize their business operations, which is conducive to developing new sales opportunities.

One such digital tool is Finanteq’s Pocket Branch (read: How does a virtual branch help to increase sales?), and Extentum platform (mentioned above), which makes it possible to create and share personalized offers with customers on the fly.

New revenue streams

Implementing more digital solutions is also an opportunity for the bank to diversify its revenue sources and increase them gradually. Banks that want to retain customers and differentiate themselves in the market are betting on value-added services (VAS) and standard banking options.

At Finanteq, we developed the m-commerce platform – SuperWallet, which offers to purchase non-financial products and services directly in the mobile bank’s application.

Read here Why value-added services in digital banking are worth implementing.

Data collection and analytics

When travelling through the digital world, a customer leaves considerable information behind. Having this data and integrating analytics with business processes is an excellent starting point for enhancing the value of every customer interaction with the bank.

Smart adoption of modern digital tools: big data analytics solutions, advanced algorithms, AI, etc., can strengthen the effects of digital transformation of financial services and determine the digital-first bank’s competitive advantage.

The collection and use of data and analytics are one of the key challenges of modern banking, but it brings with them many benefits, such as:

- a better understanding of customer needs basing on their behaviour;

- preparing tailor-made offers;

- leveraging customer buying behaviour to create a more personalized user experience;

- proactively (instead of reactively) initiating customer relationships in real-time to benefit all the capabilities of an omnichannel environment;

- initiating actions relevant to customer expectations that were not previously possible;

- automation processes through the use of ML algorithms.

What’s next for the financial sector?

Although digital adoption is already very advanced, financial institutions are still far off.

Many of them still need comprehensive strategies for reaching and engaging customers in a changed post-pandemic economy.

Some companies have not yet begun to move toward digital transformation.

According to Gartner, 91% of businesses are engaged in some form of digital initiative, and 87% say digitalization is a priority.

35% of executives report progress on their digital initiatives (Forrester). However, progress is slower than expected. Moreover, the same report says that 12% of decision-makers have only plans to execute their transformation. Even more surprisingly, 6% have no current plans.

The digitization of businesses is a reality, and further progress is a foregone conclusion. The financial industry must be technologically solid and attentive to survive, grow, and be competitive. Investing in technology and people who can use and build it is key.

Digital transformation is an inevitable challenge for the financial sector…

… and the technology can only help banks to go through it.

Banks must also think digitally in a world where the customer thinks digitally. Being the most effective and relevant player in the digital environment requires putting the consumer first and providing an excellent experience.

If you are considering a digital transformation at your bank or would like to expand its positive impact by implementing another cutting-edge solution, contact us to talk.