Nowadays, people download more and more mobile applications to fulfill all their needs. Apps are supposed to make life easier and help us to deal with everyday needs. One to order a taxi, another to buy bus tickets, yet another to order food, you name it. In theory, it works great. In practice, the growing number of applications is becoming overwhelming.

The phenomenon of tiredness of too many apps for a single thing has its own name – app fatigue. How to provide consumers with everything they need? Without having to search, download, read bloated terms & conditions. And the need to register a payment card in new, often untrusted places from the user’s point of view? The answer is simple – provide core products and services within all-in apps, known as a superwallets. Check out how it works at Revolut.

At Finanteq, we believe mobile banking apps are a powerful base for many other services except banking. People use mobile banking apps on a daily basis, and expanding its offerings seems to be a natural step in its development.

We can see the space for banks to offer value-added services (VAS), and we are confident that their implementation will bring tangible benefits.

What are value-added services and what are the main reasons for adopting them? Let’s find out!

A short introduction to value-added services in mobile banking

This actually means offering non-financial products such as ordering flowers, food, or buying tickets for cultural and sports events straight from the app. In this way, the bank’s customers enjoy a wider range of new suppliers, and the bank reaps additional benefits, such as increasing revenue, collecting insightful data like the number of transactions, and gaining customers’ loyalty through engagement.

Is this the right path in mobile app development? Of course. We can see at least 3 reasons why to go for it.

Reason 1: Increasing revenues with value-added services

Straight to the point. As mentioned before, VAS can generate additional streams of revenue just by integrating financial services into existing products.

The majority of banks have already an ideal foundation to do so – their banking app. Why not increase revenues by integrating new services into existing ones? It’s an excellent base to add new offers into it and benefit from the fees paid for each transaction. This is a great strategy for differentiating revenue streams.

Since the customer is already securely logged in to the app delivered by the trusted party, they can explore additional offers without the need to sign up for another app. This significantly simplifies the shopping experience and encourages purchases. Banks will benefit from each transaction, as merchants offering their products share the revenue with them.

Having a superwallet app moves banks from the background to the front of the value chain. Nowadays, it’s crucial to be the first contact point with customers.

Reason 2: Insightful source of transactional data

Thanks to data from superwallets, banks know what their consumers are buying and can precisely analyze shopping behaviors across various embedded m-commerce services, thus making banking and non-banking services much more personalized.

What kind of products or/and services are they buying? What are the value of each transaction and its frequency? Having it all, banks can translate this data into usable information and sell more effectively.

Reason 3: Strengthen customer loyalty with value-added services

Thanks to new services implemented into your app you can re-engage your customers and increase the number of interactions with your app. To do so, you have to offer services beyond banking that will meet all customers’ needs.

Instead of downloading another app, customers will use the banking app they already trusted. Banks may offer innovative products which wow their customers. Adding lifestyle features makes banking more convenient and eliminates the phenomenon of app fatigue.

As for the next phase for gaining customer loyalty, banks can add gamification elements and introduce discount programs for their customers. The possibilities are endless. All you need to do is implement value-added services.

Readiness to meet the customers’ rising expectations with Finanteq

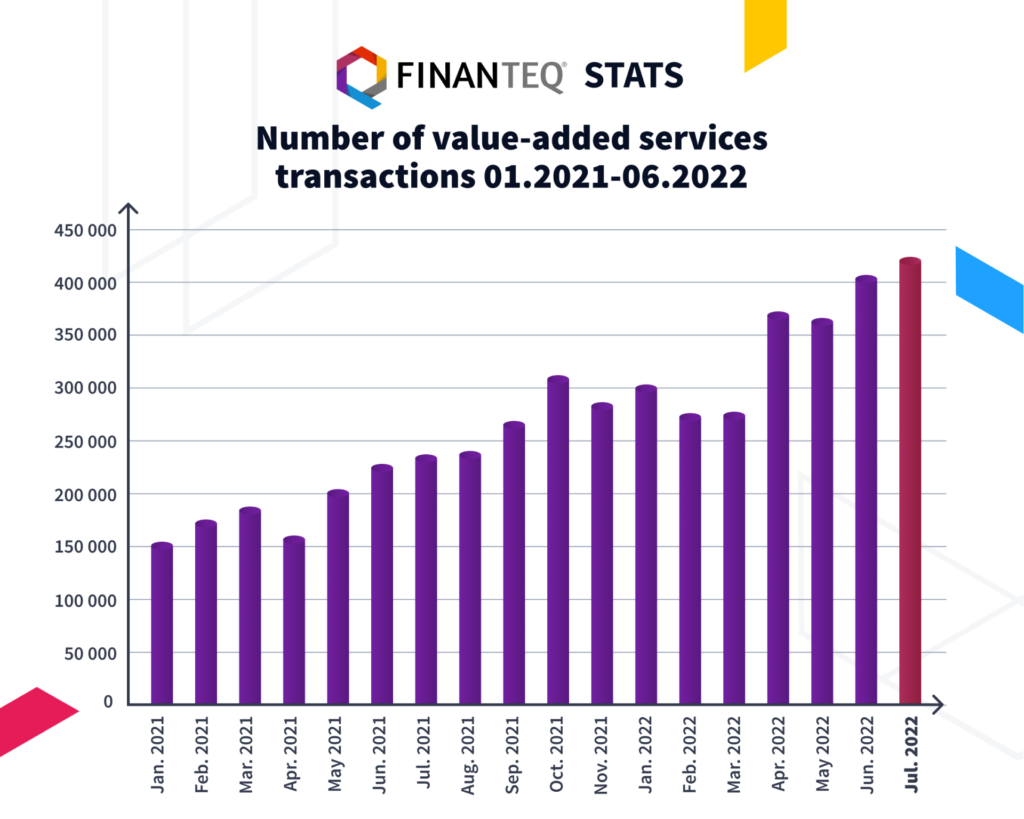

Finanteq’s latest m-commerce data show that revenue from value-added services is constantly growing with no marketing campaigns. The upward trend has continued since the beginning of the current year.

We do not doubt that the m-commerce market is not yet saturated. The addition of new products and services will significantly contribute to further growth in the number of transactions. Our data confirm that additional services are what banks customer need now. Finanteq’s m-commerce component is implemented in the biggest banks in Poland, such as Santander Bank Polska or BNP Paribas Bank Polska. Would you like to join them?

Extending your offer with value-added services is possible thanks to our SuperWallet. We deliver the solution as SaaS in Poland or an on-premise solution for foreign markets. It includes methods, libraries, and technical documentation that will allow merchants to be able to independently integrate with the system and offer their goods as well as banks to integrate into the mobile application. As an effect banks can make a wide range of value-added services available to their customers.

The biggest advantage of the mCommerce SDK over competing solutions is that the bank can enrich its portfolio with additional, innovative services on the fly.

To sum up: value-added services

All-in apps are a standout for digital banking leaders. Banks that offer additional services to their customers have a competitive edge. Only the applications they use frequently have a chance to stay on the market and generate revenue. And this is done by strengthening the relationship with customers. How? Provide them with everything they need at the right moment, with the best possible Customer Experience and the least possible Customer Effort.

Value-added services are simply the answer to changing customer needs.

Matching the needs of customers will directly affect revenue growth, and this will allow the implementation of new innovative solutions in the future. Continuous development will leave the competition far behind.

In the future, the strongest players will absorb the weaker ones. It is worth ensuring that your bank is the leader in the financial services market. In our next article, we will present the services that can you can implement using our component.