The falling number of branches and the development of new technologies reduce customer contact with the bank. Can a virtual branch rebuild the old relationship?

The falling number of branches and the development of new technologies reduce customer contact with the bank. Can a virtual branch rebuild the old relationship?

YouTube was a dating site, and Slack was supposed to be a game. Can banks change their business models the way startups do?

Every month we are flooded by a wave of electronic invoices. How to control this mess and streamline payments?

Despite the dynamic development of mobile banking apps, users still prefer to pay their invoices using a computer. How to automate invoice payments in mobile banking?

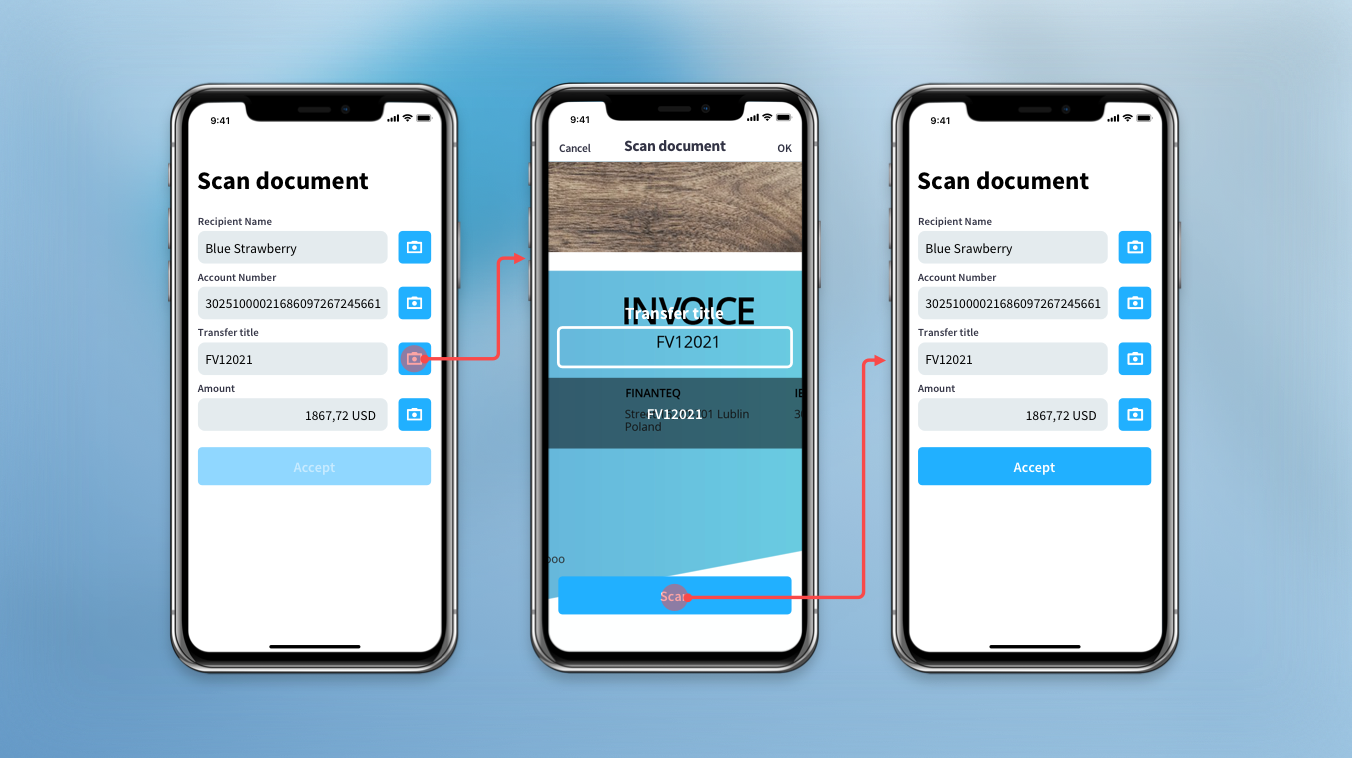

Do you plan to implement OCR technology in mobile banking and simplify bill payments for your customers? Make sure that the OCR you choose has all the desirable features.

Every year thousands of people make transfers to wrong accounts. The result? More work for the bank and unnecessary stress for the customer.

Mobile shopping done as part of the bank application is gaining popularity. At the beginning, it was only an interesting trend, but it turned out to be a useful feature which helps clients in everyday life.

Over 760 mln transactions in only a year. BLIK – the Polish mobile payment standard – transforms the face of Polish mobile banking.

BNP Paribas joins Santander Bank and Nest Bank, which have already launched the m-commerce functionality in their banking applications.

Receive our analysis about innovations from the world of mobile banking and mobile fintech. We will only send one message a month.