Every month we are flooded by a wave of electronic invoices. How to control this mess and streamline payments?

Numerous companies, e.g. from the telecommunications sector, tempt us with additional benefits if we opt for the electronic invoice. “Get rid of paper and enjoy an additional Internet package”. “Choose ecology and pay lower bills” – this type of slogans are now basically standard.

Do you need OCR solution to extract data from any invoice? Learn about our OCR for Invoice Payments and give your clients automated invoice paying experience.

Yet only a dozen or so years ago, a complete transition from paper to electronic forms seemed as difficult as quitting an addiction.

“Giving up paper is harder than quitting smoking”

Judy Bicking, Former Global Director of Shared Services, Johnson & Johnson

Judy Bicking knows what she is saying – at J&J they had to deal with over a million paper invoices a year.

Today everything has changed dramatically. It is estimated that in 2015 there were 500 billion invoices in circulation — of which only 42 billion were paper invoices.

Along with the increase of e-invoicing, there is a growing need among people to be able to pay, here and now. Preferably with your smartphone and your bank’s mobile app.

Unfortunately, paying an invoice saved in the PDF format on your mobile takes a few precious minutes and requires your maximum attention. Transferring data from the e-invoice to the mobile application is not particularly convenient.

Mobile banking application vs. paying electronic invoices

The number of monthly financial commitments that need to be paid promptly and efficiently could overwhelm. These include:

- internet and telecommunications services,

- electricity, gas and other utility bills,

- rental fees,

- invoices from subcontractors.

No wonder then that bank customers often have trouble controlling the mess in their payments (e.g. 30% of Americans are paying for subscriptions without knowing it).

Although more environmentally friendly (switching to electronic invoices can reduce carbon dioxide emissions by up to 40,000 tonnes per year) and easier in distribution than paper ones, electronic invoices also have their downsides. Especially on mobile devices.

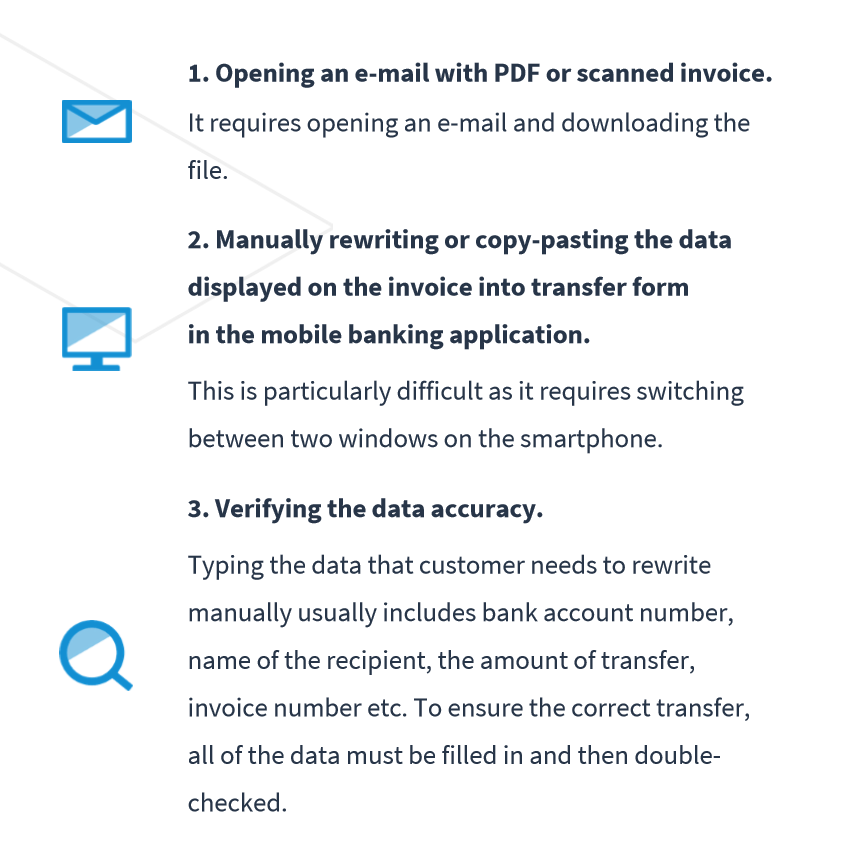

The customer has to download the invoice from their e-mail, then retype or copy the data from it to the transfer form within the application, and finally verify its accuracy. Whoever goes through the process regularly knows perfectly well that doing so on a smartphone requires enormous precision and continuous switching between applications screens.

The whole process is illustrated by the following infographic:

There is no room for mistakes or inaccuracies here – one of these might be costly, especially for entrepreneurs (read our article on wrong money transfers).

Be more digital

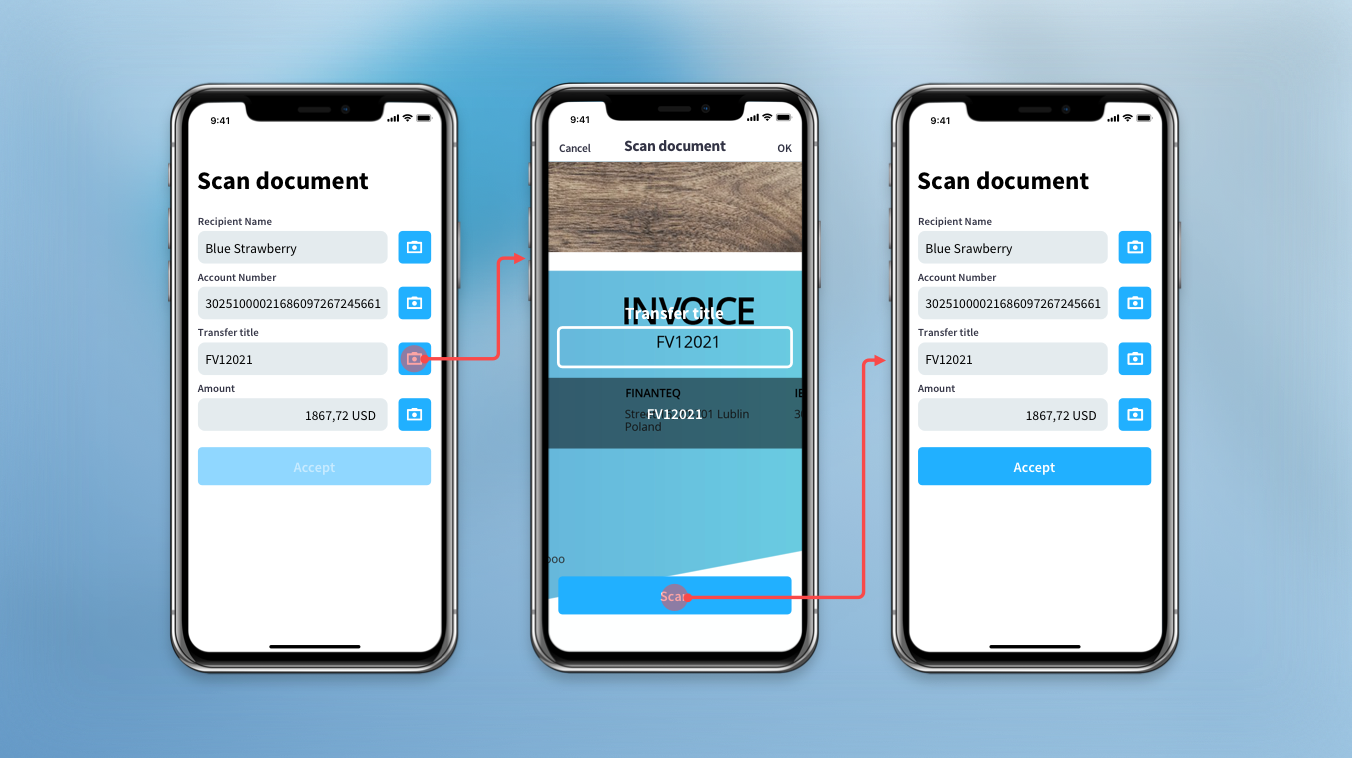

The bank cannot remain indifferent to the e-invoice revolution and the inconveniences it causes to users. To solve their problem, the bank should add an invoice scanning module to their mobile application.

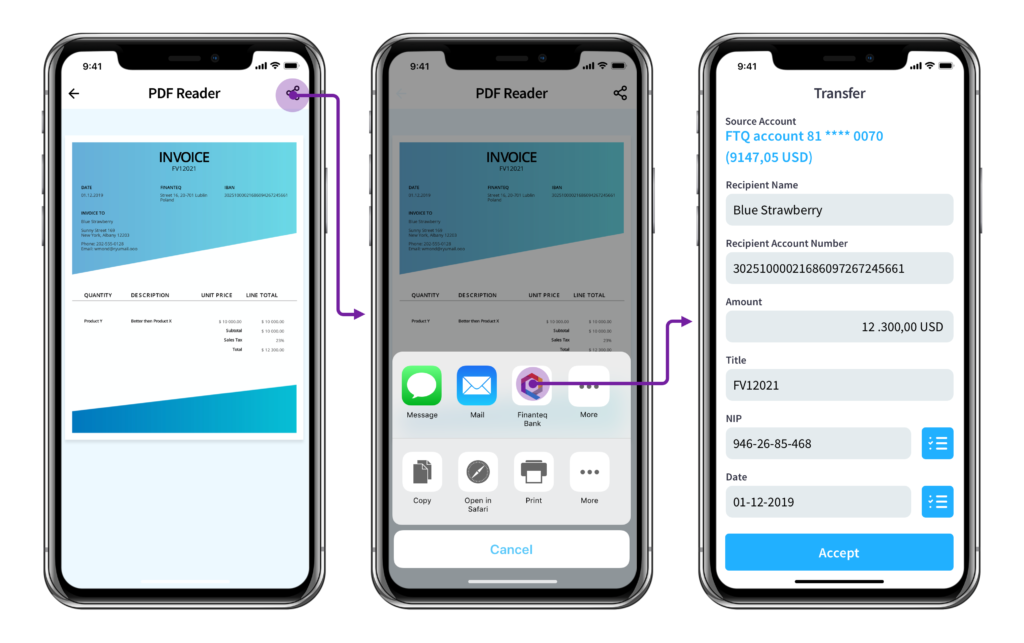

With this module, the application automatically scans the data from the file, while the customer immediately receives a completed transfer form ready for authorization – quickly and effortlessly, without the need for tedious copying and pasting:

A PDF imported this way does not only enable automatic completion of the transfer data, but it can also be stored in the user’s personal payment calendar in the bank.

Such calendar will help the client to find a previously paid invoice and, if necessary, remind them of an upcoming regular payment or warn about a possible lack of funds.

The invoice scanning component not only reads data and transfers it to the payment form in the mobile banking application, but also checks the accuracy of the data, e.g. by verifying the bank account number on the invoice or other standard numbers. Therefore, the risk of making an error or typo while filling in the form is practically eliminated (compared to the situation where the user enters data manually).

Benefits for the user? Less stress, fewer mistakes and less time consumed by paying invoices. And the benefit for the banks? Positioning their organisation as future- and security-oriented, qualities so greatly appreciated by both individual and corporate customers.

______

If you would like some more information on how to pay invoices more easily – both those electronic and paper ones – using mobile banking, download our e-book on OCR.