Let’s start with a quick recap of our last year’s banking trends predictions. Recently, we mentioned video banking, m-commerce, artificial intelligence, no-code, and smartwatch banking. These trends will stay with us for a long time, but they will adjust to the current economic situation.

There is no doubt that the banking sector has reached a turning point. According to the latest World Bank predictions: “The global economy is perilously close to falling into recession.” Global inflation is galloping, and central banks are fighting it by raising interest rates.

Due to the bleak forecasts for the global economy and changing consumer needs, banks, to remain competitive, must consider revising their approach to:

- diversify their streams of income,

- meet increasing customers’ expectations.

What does it mean? Financial institutions must take advantage of the current situation and add new banking services and products on their roadmaps to further expand their revenue sources and increase the loyalty of their customers. The latest trends in banking technology prove that most financial institutions are considering significant changes in how they operate.

Banking Trends: What’s new in the banking industry?

Will banks freeze investment in high-tech due to the difficult economic situation? Definitely no. It is these expenses that will pay the greatest return in the future. Below we present a compilation of trends to keep an eye on to respond to market changes.

The continued rise of digital banking

We are at the point of intensifying the development of mobile applications. Banks invest in applications’ facelifts, or even building a new generation from scratch, to make them faster, more modern and more customer friendly with new financial products available from the app. A good application will certainly attract customers, while a poor one can be one of the reasons for customer (and cash) outflow. Mobile app R&D is an ongoing digital banking trend.

Also, mobile banking apps are more often being reshaped into super applications. The trend of transforming banking applications into powerful platforms is precisely the answer to the challenge mentioned in the introduction of seeking new sources of revenue and, furthermore, strengthening the loyalty of their customers. How? I will explain it later.

At the same time, we can observe an intensified focus on cybersecurity. Cyber-attacks in the financial industry are occurring with increasing frequency. Recently, as many as 56 banks were exposed to an attack by a new trojan, Xenomorph. And this is just one of many types of threats to banks. So it’s unsurprising that banks are looking for more and better ways to combat hackers. Also, the average cost of a data leak in the financial industry is the second highest after a leak in the health industry averaging $5.97 million. Therefore, preventing cyber-attacks must be crucial for banks to avoid unexpected costs, especially in not stable times for them.

Increased use of new technologies

Enhanced interest in modern technologies includes the use of no-code technologies, which will significantly reduce development time and costs by enabling the new functionality almost in a flash. What is most important when it comes to no-code – new functionalities are built by business people, without the involvement of expensive coders. Combining no-code with big data lets banks personalize the front-end and suggest customized offers for each customer type individually which significantly boosts sales.

Also, using open banking APIs to permit third-party access to customer data will be more visible in upcoming future. Data sharing between authorized entities makes new products and services available also to banks’ customers. What benefits does this bring to them? For example, it enables users to manage their finances more innovatively thanks to tools like budgeting apps. Also, third-party providers may use customer data to offer tailored lending solutions, insurance products, investment opportunities and more. This trend is both an opportunity and a threat for banks.

Lastly, the emergence of an increasing number of solutions based on blockchain technology can be used in many financial applications, for example, for digital currency payments and security, which also enhances CX.

Stronger focus on personalization and customer experience

Leveraging big data and analytics to gain insights into customers’ expectations and preferences, customizing products and services to meet their individual needs, offering personalized financial advice and support – all of these is crucial today.

The consequence of expanding the application is the need to constantly work on adjusting and improving the user experience to new features. Devoting attention to UX is a trend that will stay with us forever because working on app usability is a never-ending process.

Also, using AI and chatbots to improve customer experience is becoming mainstream. However – the majority of customers still prefer face-to-face interaction when it comes to complex financial products. This is why the virtual branch experience with a human face is particularly desirable.

Increased emphasis on sustainability and social responsibility

It’s a huge part of the biggest banks’ strategies. One of the best examples is Santander, Standard Bank Group or mBank. With more financial institutions committing to sustainable finance initiatives, offering green financial products and services, and addressing social issues such as financial inclusion and income inequality is becoming a must have. Technology simply helps to achieve sustainability goals. General public awareness of sustainability is growing, so banks are getting involved in this area.

Organizations that will find the above trends useful and adequately respond to them will be able to provide a more compelling value proposition to their customers and increase their revenue at the same time.

The aim is to put the customer at the heart of everything banks do and use digital transformation to enable efficiency gains and better service delivery.

Impact of trends on customers: How banking trends affect the customer experience

Solutions and products dedicated to improving CX are becoming increasingly popular. Recent trends in financial services prove that there is now an increased focus on meeting customer expectations.

Come back of human interactions in digital channels

A greater focus on customers’ needs will translate into more human touch in all digital channels. It starts with top-notch remote customer service. We all know that artificial intelligence and chatbots are present in an increasing number of websites and applications… but are we satisfied with the quality of their “services”? I am afraid that not yet. This is why the return of customer service covered by consultants is experiencing a renaissance.

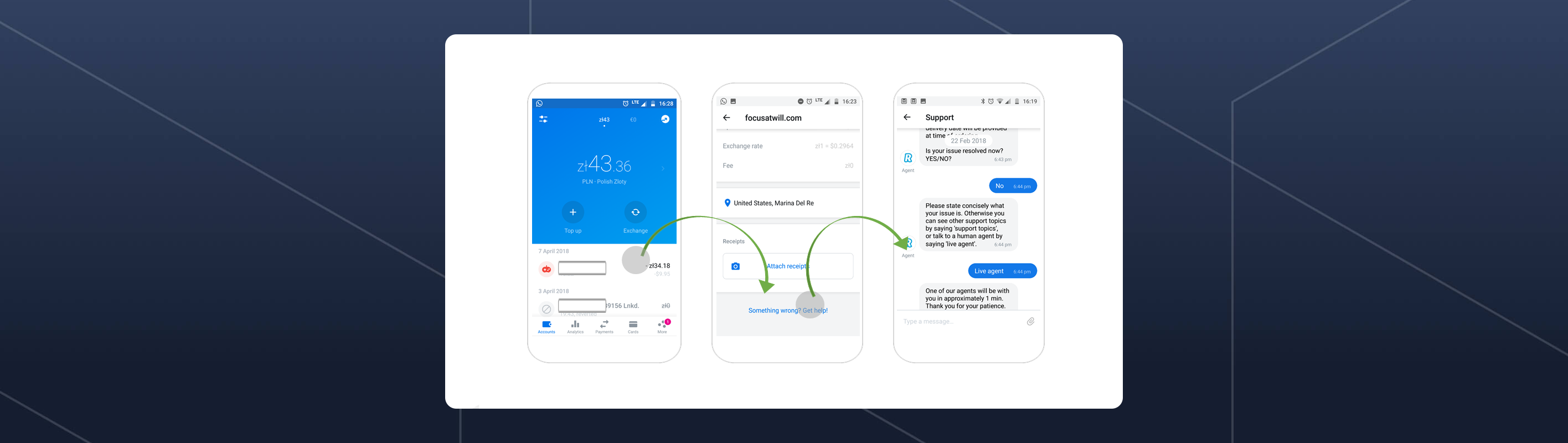

Solutions like Finanteq’s Pocket Branch, are created to help customers understand complex financial products and simplify the sales process. They will appreciate:

- the opportunity to resolve their issues through digital channels and 24/7 accessibility,

- simplicity and intuitiveness of the tool,

- personal, eye-to-eye contact with the advisor,

- sets of supporting features improving the whole experience.

Discover how we can help you unlock the full potential of remote communication – download Product Overview.

New services in banks’ portfolios to increase user convenience

People like to have everything at hand. This was the stimulus for transforming the mobile banking app into a super app allowing users to purchase non-banking products and lifestyle services. What might these be? App users can buy bus tickets, make parking payments, pay for toll roads, buy gifts and spectrum of events tickets, or send flowers – everything by implementing our SuperWallet component.

As mentioned at the beginning, banks should look for a new revenue stream, and value-added services are a great fit here! Every customer will appreciate a broader range of services. Totally win-win situation!

Concern for safety

Hacker attacks on banking applications have an visible and significant impact on CX, a huge effect on the financial side of the business as well as image losses for the banks. In 2022 alone, were detected: 1,661,743 malicious installers, 196,476 new mobile banking Trojans and 10,543 new ransomware Trojans. So, the threat is as real as it gets.

All bank customers unquestionably expect the highest level of security – awareness of the top quality of services in this area translates into an understanding of CX adjustments by the end-users. As a result, another trend in banking has emerged – collaboration regarding security with external companies.

Analyzing the products available on the market, at Finanteq we recognized that the leading solution in this field is Promon Shield – a runtime application self-protection (RASP) solution. It instantly detects and blocks all threats, preventing the application from turning on if it sees any danger.

Learn more how to enhance the banking customer experience with ready-to-use solutions in our article.

Impact of trends on bank employees: How banking trends are changing the workforce

How are modern technologies changing the labor market? Are they a threat to workers? Or is it an opportunity after all? Let’s check!

No-code – better allocation of resources

We will explain it by revealing some information about our no-code solution – Extentum. The tool was developed based on our years of experience in the banking industry. Put simply, it allows non-technical people easily expand an existing banking application – and the changes made appear in the app almost immediately.

If you think about the IT industry, the first thing that comes to mind is probably the shortage of programmers on the market. Extentum gives an opportunity to use business-skilled professionals, such as product owners, marketers, analysts and other business experts (even people without IT knowledge or UX skills) to implement new features via a simple visual tool set.

It brings a number of benefits:

- Possibility to engage programmers in more complex tasks.

- Facilitating recruitment of various professionals.

- Reducing the cost of development of new functionalities.

- Shortening time to market.

It’s definitely technology which can change the structure of IT industry and labor market, but only for better! For technical details, please download the Product Overview of the solution.

Pocket Branch from behind the scenes

We must mention Pocket Branch in the context of streamlining the work of bank advisors. The solution undoubtedly significantly improves the customer experience, but the functionalities advisors can use are invaluable.

Selected improvements for the advisors:

- Active participation of both parties simultaneously is not necessary, thanks to asynchronous communication.

- Multi-chat feature enables advisors to communicate with multiple customers simultaneously using chat-only mode.

- The supervisor can transfer the conversation from one advisor to another.

- Pre-prepared answers are provided to enhance the efficiency of advisors’ work.

Please, read more on how the bank’s employees can properly and conveniently conduct a video conference with a client thanks to Pocket Branch.

Emerging technologies in the financial services industry will surely change the requirements for skills and competencies, increasing the need for new qualifications and allowing potential employees to pursue the professions of the future.

Best practices for adapting to banking trends: What you need to do to stay ahead

Here’s few tips for all banking executives to win the market today.

- Always put your customers and employees on the first place. Have in mind that digital transformation must move toward improving customer and employee experience.

- Provide a clear direction to all stakeholders. All top managers in your organization, including the management board, must agree on the direction the company should take. This should be translated into the organization’s mission, vision and strategy.

- Rethink the risks associated with digital transformation. Examine the strengths and weaknesses of your strategy.

- Track progress and modify strategy when needed. What is true today will not always be true tomorrow. You need to be agile and open to change.

- Stay on top of trends. Watch not only the banking industry, but also what is happening in the world of technology. To do so, we highly recommend signing up to our Finanteq Insights.

What will banking industry look like in the future?

McKinsey, a consulting firm, anticipates that in the coming years, banks and non-banking institutions will compete in five distinct areas of the financial industry: everyday banking, investment advising, complex financing, mass wholesale intermediation, and banking as a service (BaaS). We also see the vast potential of Value-Added-Services (VAS) implemented into banking applications as another source of revenue for banks.

When discussing future banking industry trends, the metaverse cannot be overlooked. Digital champions striving for excellence in the digital realm are already incorporating metaverse into their strategies – to offer their customers fully immersive VR/AR experiences.

Will this be the future? It may seem improbable now, but 20 years ago mobile apps were also approached with skepticism but at Finanteq we knew that the digital-only direction was the right way to go. Similarly today, we predict that the above-mentioned trends trend are here to stay.

For sure, in 5 or 10 years, the banking industry will be different than it is now, but mature and conscious organizations will benefit from all changes.

To sum up

Now is an excellent time to turn current banking technology trends into new revenue streams and provide additional value to your customers, thus increasing their satisfaction and loyalty. You can quickly achieve this by opting for solutions like the no-code tool, virtual branch or m-commerce VAS mentioned in the article.

If you are looking for the best, trusted partner to build a digital future, it’s the right place. Contact us to explore our extensive range of products and services. We will recommend the best options for your project based on our extensive banking expertise.