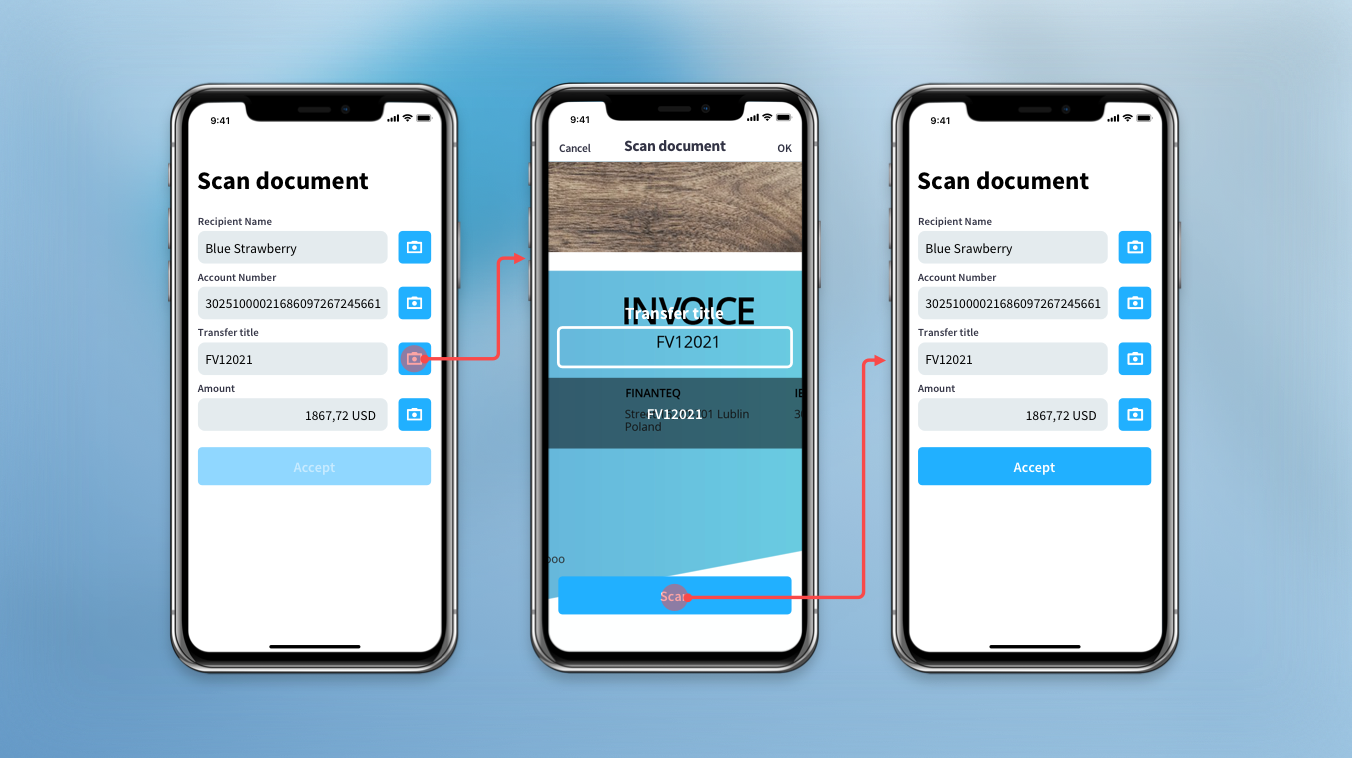

Are your customers still entering data manually from invoices into your mobile banking app? Let them capture it!

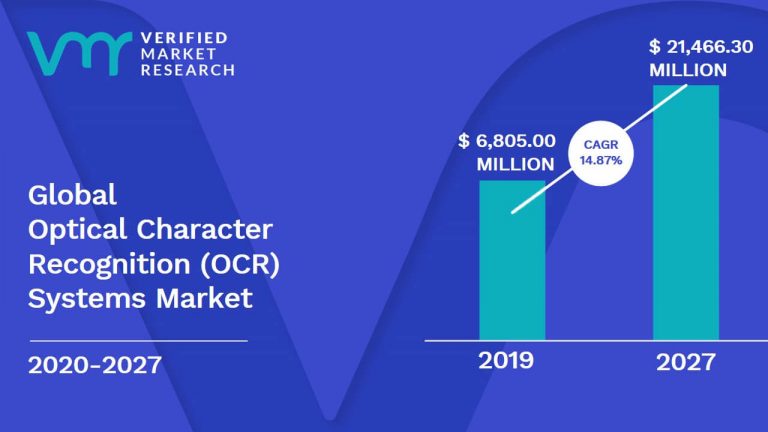

Optical character recognition (OCR) technology is becoming increasingly popular, particularly in core sectors such as Banking, Financial Services and Insurance Industry (BFSI), Transport and Logistics, or Retail & Manufacturing.

According to Verified Market Research, the OCR Systems Market is projected to reach USD 21,466.30 Million by 2027, at a long-term CAGR of 14.87% from 2019 to 2027.

Source: Verified Market Research

There is no doubt that financial institutions must implement OCR technology in their apps and optimize the process of entering all types of data.

OCR technology strengthens key areas of the organization and increases business efficiency.

Check out FINANTEQ’s OCR for Documents solution

Let’s explore how OCR technology can take the mobile banking experience to the next level.

Three examples of improving Customer Experience and minimalizing Customer Effort with OCR technology supported by AI

Maximization of Customer Experience and Minimalization of Customer Effort are important factors financial instructions have to concentrate on today.

In the following article, I will focus on how OCR technology impacts customers’ mobile banking experience.

Improvement of paper invoice process payment

Jacob is a sole proprietor. He has to pay a massive bundle of invoices from various contractors every month. Most invoices are still paper invoices. Manual data entry from those invoices consumes a great deal of his time. This is an activity that Jacob would like to make more efficient. How?

Fortunately, Jacob’s mobile app comes with FINANTEQ’s OCR for Invoice Payments component that solves his problem.

Thanks to it, he can conveniently scan all data from the invoice using just a smartphone camera. Starting with the recipient’s account number, title, amount, and ending with the date of the payment.

Jacob doesn’t need to enter data manually from a paper invoice anymore.

Additionally, OCR for Invoice Payments component validates the accuracy of most types of data (VAT identification number, bank account number, etc.) which is particularly important for entrepreneurs.

That is a significant improvement of the invoice payment process. It simply saves time, minimalizes customer effort, and maximizes customer satisfaction.

Payment of e-mail invoice by a dedicated e-mail address

John at his work gets many e-mail invoices. He used to copy and paste all data manually to proceed with the payment.

However, lastly, the bank where his company has an account implemented OCR for Invoice Payments with the possibility of payment automatization.

He received a dedicated e-mail address from the bank, which acts as his virtual assistant.

John sends an e-mail with an attached electronic invoice to the assistant’s address. Then, in a moment, he receives a notification from the bank’s application about the new payment waiting for confirmation.

Just a click on the notification, authorization of the transfer order with data automatically scanned from the submitted invoice and, that is it.

But, there is one more lifehack that will simplify the process. John sets up an automatic forwarding rule on the selected message to his assistant in the bank, thanks to which he does not have to send e-mail invoices manually.

John is glad that it’s another repetitive activity that can be fully automated.

Payment of PDF Invoice with reminder option

Olivia usually uses her MacBook to pay her invoices via online banking. She copies or even rewrites data from the invoice to the payment form from her bank.

Olivia typically makes payments for the same services or products, such as phone, internet, or electricity bills. She lives intensely and, despite fixed payment dates, sometimes she makes it beyond the deadline. She would appreciate the reminder option.

With OCR for Invoice Payments component implemented in Olivia’s Bank digital banking, the payment process can be much more convenient.

Thanks to this feature she can pay invoices easily by loading the invoice file on the internet banking website.

An invoice file imported this way is scanned and allows for automatic completion of transfer data. It can also be stored at Olivia’s bank’s repository or private cloud (i.e. Google Drive) and notify her of the payments deadline.

The payment assistant feature will help to find the previously paid invoice and, if necessary, remind her in advance of the upcoming regular payment or warn about a possible lack of funds on the account.

Anyone with a lot of things on their mind will appreciate this functionality.

To wrap up

Top banking players must be realizing the need to adopt digital services on the fly to stay competitive in the industry and not risk getting left behind. OCR technology is one of the solutions that is a must-have in any mobile application.

As the above examples show OCR technology improves Customer Experience and Minimalize Customer Effort. The number of potential use cases is endless. Both customers and employees will benefit from OCR implementation.

OCR technology significantly improves internal banks’ process efficiency and simplifies the bank’s employees’ work.

OCR for Invoice Payments and OCR for Documents Components created by FINANTEQ are dedicated to the banking sector.

Thus, our solutions are fully prepared for integration with an existing banking application and systems.

Main benefits of our OCR components:

- Optimized for most devices

- Universal design ready to adjust to any mobile app style

- Easy implementation thanks to native SDK libraries

- Data validation to eliminate human errors

- High customization possibilities

- Delighting Customer Experience

- Minimalizing Customer Effort

Sounds like a solution for your institution?