Knowing the customer’s opinion is obvious to businesses today. In fact, the clients are the only and most important guarantors of the survival and development of the company, and their satisfaction is one of the key factors indicating the desire or reluctance to continue cooperation.

How do companies know if a customer is satisfied? How can they find out?

Simply by conducting satisfaction surveys.

And how satisfied are our customers? What do they appreciate most? Let’s find out!

The goals of the customer satisfaction survey at Finanteq

Many modern organisations are increasingly and willingly implementing various solutions for measuring customer satisfaction.

Annual customer satisfaction surveys are a regular part of business relationships at Finanteq. They provide feedback on our operations and verify the quality of the work of those involved in the project and cooperation with the client. Honest feedback from our clients enables us to improve the quality of our services and contributes to product development.

The primary purpose of our company’s customer satisfaction survey is to verify that we are meeting the needs and supporting our clients’ business goals.

The data obtained also helps to identify aspects of cooperation that need to be improved but also shows the positive aspects of the activity in the project.

Based on the survey data, we take real action. We analyse the identified problems, pointed out elements of cooperation, and set up a plan to correct them.

In turn, the praise received is the best proof of customer satisfaction. Positive feedback from our existing clients is precious to us, as it is one of the essential factors that potential new clients consider when choosing a vendor.

Customer satisfaction survey organisation

The survey was conducted in January 2023 and focused on cooperation with banks in 2022.

We surveyed representatives of seven cooperating banks. The research group included representatives from IT and business.

The study included thirty-four respondents.

The tools we used at Finanteq were intended to be simple while providing information on what areas in our cooperation need to be changed or optimised.

As part of the survey, we conducted the following:

- Net Promoter Score (NPS) survey,

- Customer Effort Score (CES) survey,

- a custom survey researching specific areas of partnership.

What’s interesting is that for the first time, we used an in-house tool to prepare and conduct the surveys – Extentum – a low-/no-code platform designed for mobile banking development on the fly. One of the options Extentum offers is the ability to organise and share survey scenarios with banks’ customers.

Net Promoter Score (NPS)

In short, Net Promoter Score (NPS) survey measures customer experience, customer satisfaction and loyalty to a specific brand. The questionnaire predicts whether a client will repurchase from a company or refer its product or service to someone else.

It is a popular survey, used actively worldwide, in many industries and with the “biggest players” (e.g. Apple, Amazon, Netflix, Tesla). It is also being conducted increasingly frequently in B2B and is well-known in the IT sector.

In our survey, according to the NPS methodology, we asked clients the following question:

On a scale of 0 to 10, how likely are you to recommend Finanteq’s services?

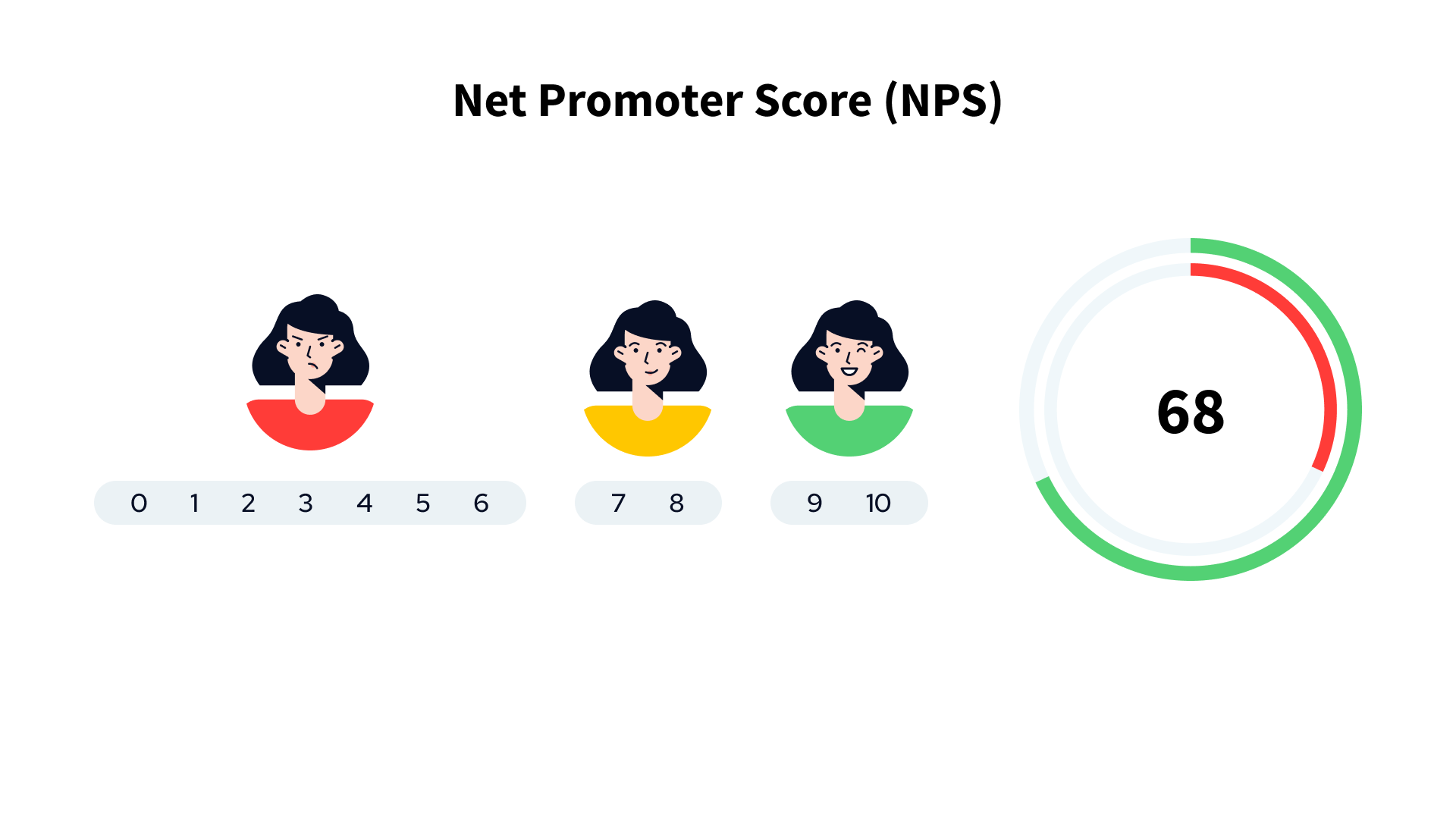

Respondents express their willingness to recommend on a scale of 0-10, where 0 is the lowest rating (“not likely” response), and 10 is the highest rating (“very likely”).

Respondents are then assigned to one of the following NPS categories, depending on their answers:

- Promoters (satisfied and loyal clients – 9 and 10s),

- Passives (unenthusiastic clients, 7 and 8s),

- Detractors (unhappy clients, rating the services in the 0 to 6 range).

To calculate a company’s Net Promoter Score, it is necessary to subtract the percentage of Detractors from the percentage of Promoters.

NPS = % promoters – % detractors

The result is presented in values from -100 to 100.

Finanteq’s NPS score

Finanteq’s NPS score in 2022 is 68.

Is it a good NPS?

Is it a good NPS?

If we talk about the NPS score, it seems natural to ask: what is a Good Net Promoter Score? However, the answer is not obvious and may depend on many factors.

Generally, any NPS greater than 0 is positive and sound, as it shows directly that the number of satisfied customers exceeds that of dissatisfied ones. A score above 30 is considered great, while a score above 70 is excellent and ranks the company among the best.

However, when analysing the NPS score, it is also worth looking at the benchmarks in a given industry. Any medium or high score in a specific sector is beneficial. A high score means customer satisfaction may put a company ahead of the competition.

What does Finanteq’s result reveal, then?

Relating Finanteq’s score (68) to both overall and industry benchmarks, it is clear that our score is definitely perfect! Our clients are satisfied and will likely recommend our services to other companies.

The NPS survey is simple to use, but despite popular opinion, the results do not fully determine the level of loyalty on the client’s part.

To get a more holistic picture of customer satisfaction and loyalty, at Finanteq, we additionally studied the level of customer effort.

Customer Effort Score (CES)

Customer Effort Score (CES), which derives from customer satisfaction surveys, is an increasingly popular metric that measures a product or service’s ease of use to clients. It reflects the amount of effort a customer had to put in to use a product/service or get the problem solved or a company’s facilitation of the service.

Customer effort is the most substantial factor in determining customer loyalty or disloyalty.

In the CES survey, we asked our clients:

To what extent do you agree with the following statement: “Finanteq facilitated my mobile app development”?

Respondents provided answers following a five-point (1-5) Likert scale rating, where 1 means “strongly disagree” and 5 “strongly agree”. The less effort the customer had to put in, the better the CES score (and thus probably greater customer satisfaction).

Finanteq’s CES score

Finanteq’s CES score in 2022 is 4.5.

What is a good customer effort score?

What is a good customer effort score?

As with NPS, defining what CES is considered good is hard. No general standard benchmark exists because companies use different ranges to measure CES – different numeric scales and even pictorial ones (e.g. happy and sad faces).

However, the universal rule is the higher the CES, the better.

A high score means that the company provides a seamless experience for the clients, while a low CES means that people consider processes burdensome or customer service ineffective.

Looking at Finanteq’s score – we can be proud of ourselves. A score of 4.5 is an excellent result.

The CES confirms that mobile app development with Finanteq is easy and keeps our clients happy and loyal.

Custom survey

Measuring and being aware of customer satisfaction and effort level is crucial at Finanteq as it determines customer satisfaction. We conducted one more survey to get an even closer look at customer opinion and experience.

The survey consists of questions that address the following areas:

- software quality,

- speed of solution delivery,

- support during the resolution of difficult/challenging situations,

- security of Finanteq’s solutions,

- innovation.

Our clients answered the questions on a five-point range (1–5), where 1 means “very bad” and 5 “very good”.

In addition, at each point in the survey, the respondent was asked to identify strengths and areas for improvement.

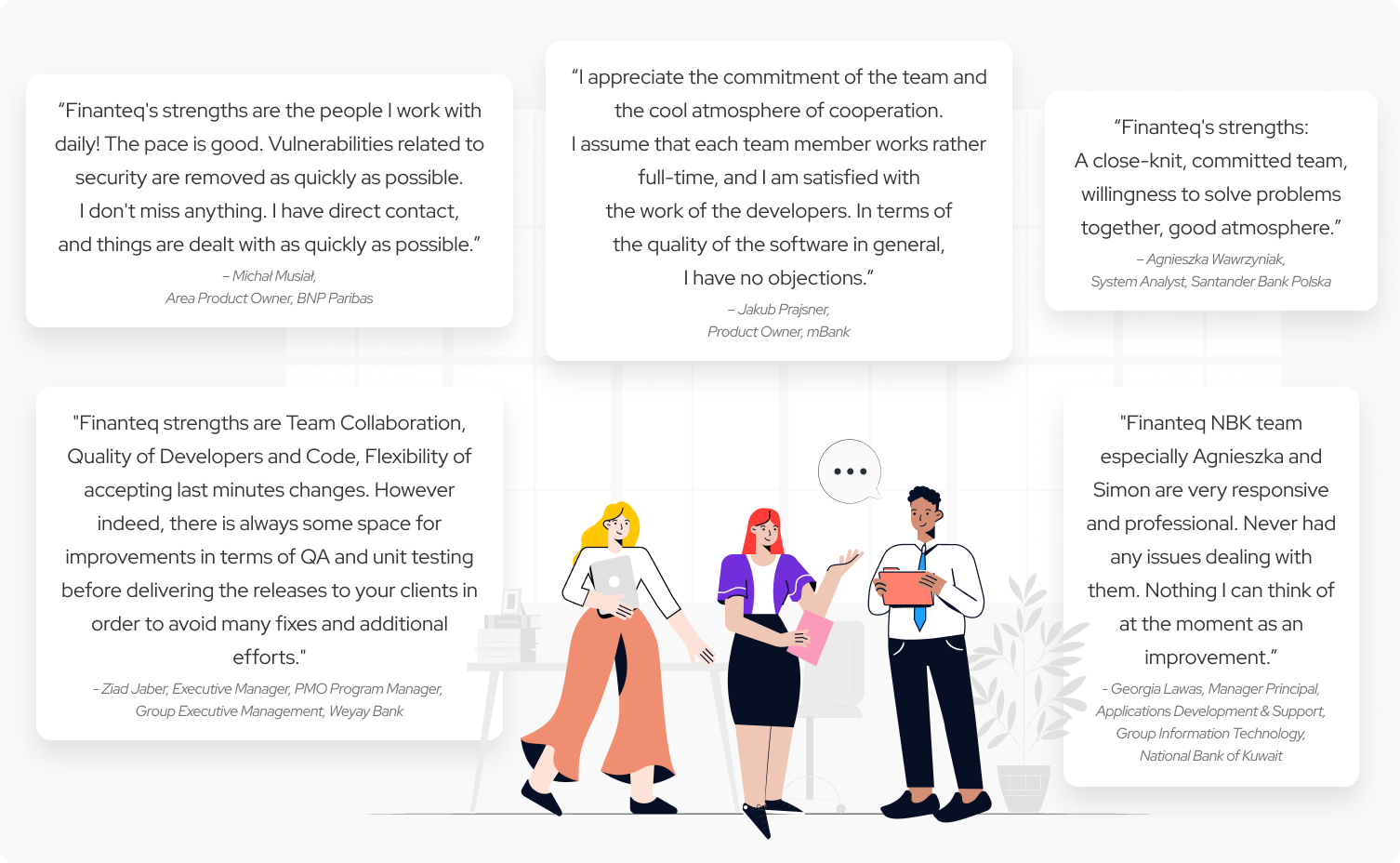

Let’s look at the client’s opinions below.

What do our clients say?

What do clients value us for? What strengths does Finanteq point to?

The words speak for themselves:

Conclusion

In the operation of any business, customers are the most important because, as a company, we depend on them.

In such a specific and long-term relationship as mobile application development, customer orientation is even a condition for the company’s survival. It is the clients who say “check.”

To stay in the market, it is necessary not only to know the needs and expectations of the clients but also to conduct satisfaction surveys to seek their opinions, even if you are concerned about the results.

More importantly, conclusions should be drawn from the surveys to improve what needs to be fixed, to strengthen the areas that customers value most, and to implement innovations that are important to customers (because they were indicated in the surveys).

At Finanteq, we are not afraid of surveys – the results are outstanding. Still, each survey is also a valuable lesson for us, from which we learn to improve the quality of our services continuously.

Find out how satisfied YOU can be with our services. Get in touch to discuss mobile banking solutions.