Every year thousands of people make transfers to wrong accounts. The result? More work for the bank and unnecessary stress for the customer.

According to statistics, about 25% of people surveyed last year accidentally transferred funds to the wrong person. What is more, over 28% of those who made such mistake have never received a refund. In the era of the rapid development of mobile banking, when a transfer takes less time than ever it is easy to make this kind of mistake.

Haste, some kind of distraction and the money could go to the wrong recipient. Electronic payments with their multi-stage identity authentication systems are highly secure, but they do not protect the user from the most probable threat – a human error.

Oversight which could cost a lot of nerves and money

Transferring funds to the wrong account might cause serious problems when it comes to paying invoices. A person making such a operation may end up in arrears with payments without even being aware of it. The customer believes the invoice has been paid, while in fact the money has gone somewhere else.

25% of people surveyed last year accidentally transferred funds to the wrong person.

Let’s face it – making transfers via mobile application is still rather inconvenient. Whether you have a paper or electronic invoice, it is often necessary to fill in a transfer form, which requires transcribing or copying a lot of data (account number, name of the recipient, invoice number etc.).

It is not difficult to make a mistake, especially if the person authorizing the payment is tired or distracted. The size of smartphone screen size does not make the task any easier. Typical situations encountered by users:

- sending a transfer to a non-existent account,

- sending a transfer to an inactive (closed) account,

- sending a transfer to an existing but incorrect account (e.g. transferring funds to a foreign currency account instead of a savings account),

- sending a transfer to an existing account, but to the wrong person.

What should you do if you made anincorrect transfer? Make sure to contact your bank in the first place. The complaint consideration process is different for each country and dependant on local legal regulations. In Poland, for example, the bank is obliged to contact the person who received the invalid transfer within 3 days.

The recipient has 30 days to return the transfer. If the money is not returned within this period, the sender has the right to report it to the police or file a lawsuit for unjust enrichment.

Regarding the United Kingdom, the financial institution involved (e.g. a bank) is required to take action within 2 working days. If it is unable to recover the funds immediately (e.g. the recipient contests the reimbursement), the institution conducts an investigation and sends the customer a notification of its result within 15 working days. If the outcome is not satisfactory, the wronged customer can complain to the Financial Ombudsman’s Office.

What does this mean for banks? Additional work – a pile of complaints and applications to be processed. And if no help can be given (because the unintended recipient does not want to return the money for example), there is a taint to the bank’s image and a drop in customer’s confidence.

There is no technology that would fully exclude the risk of human error, but there is one technology that can significantly reduce it – Optical Character Recognition (OCR) in conjunction with the data verification function.

How does OCR reduce the risk of making a mistake?

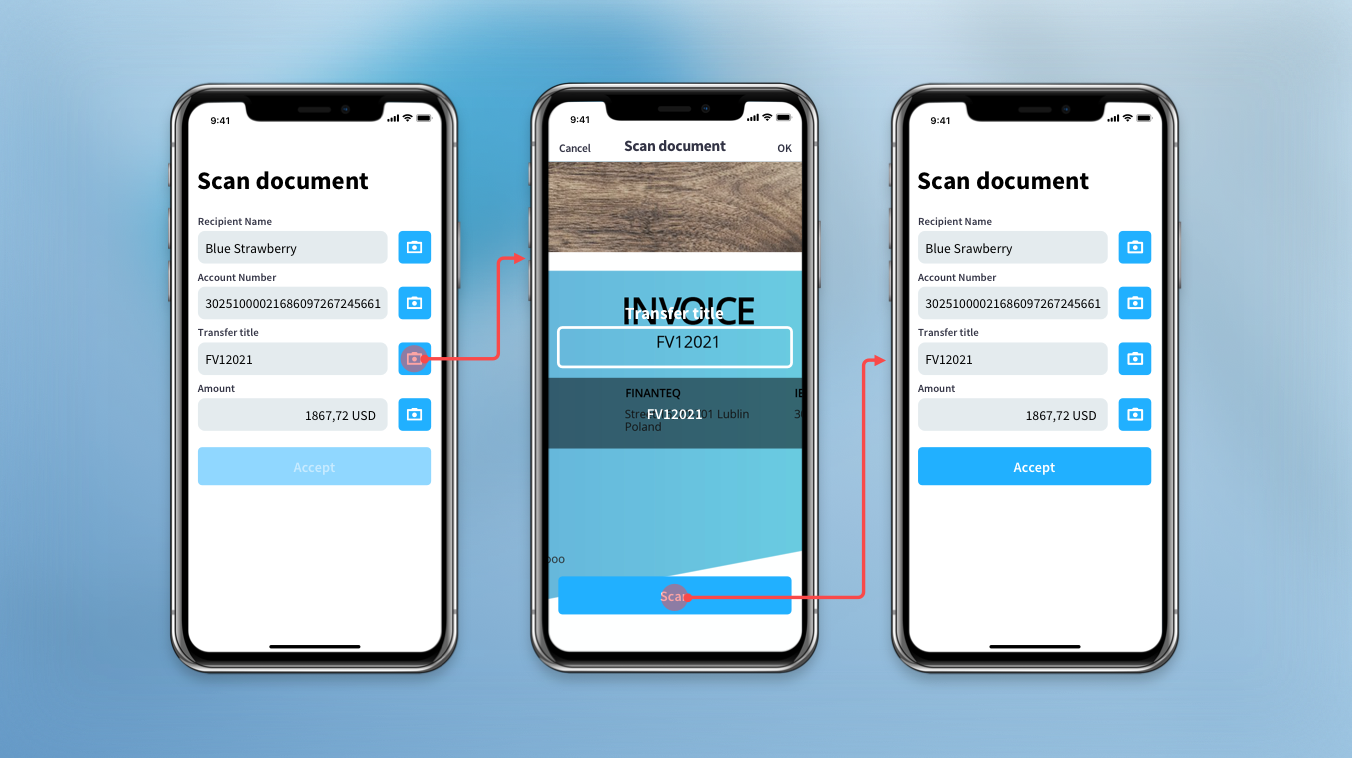

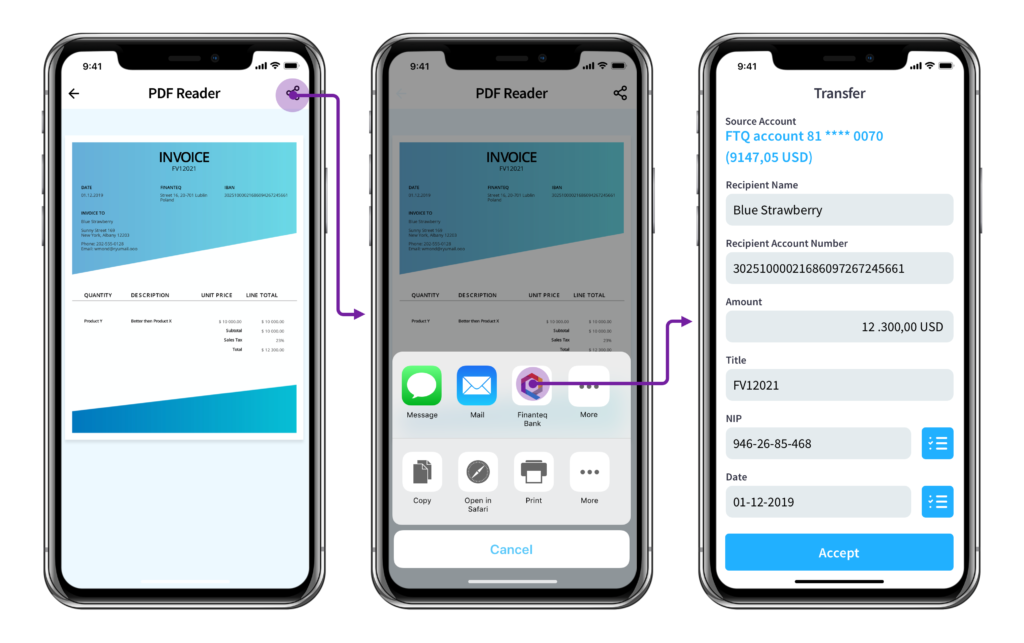

More information about the OCR technology and its essential features in mobile banking can be found HERE. For the sake of clarity, this module reads data from an invoice (both in the PDF and paper form) and pastes it into the transfer form in the bank’s application. Additional value? Lowering the stress which might cause the customer to transfer money for the invoice to the wrong account. All of this is possible thanks to data verification and subsequent confirmation of its correctness.

How does it work? With the help of the bank’s mobile application, equipped with the OCR component for invoice payments, the user scans the invoice or attaches it as a PDF file. This way the transfer data will be automatically filled in and simultaneously checked for its correctness. The following data is verified:

• transfer amount,

• transfer description,

• transfer beneficiary name,

• account number.

With a real-time preview of the scanned data, the user can verify it before sending it to the proper form. The risk of making a mistake or typo while filling in the transfer form? Practically none.

The use of the OCR component in payments for invoices benefits both customers and the bank. For the customer, transferring money becomes much easier and smoother – scanning data or extracting it from a PDF is quicker and less annoying than copying it manually. Apart from convenience, it also assures an increase in security thanks to the detection of irregularities concerning the transfer data.

And what does the bank gain from choosing the OCR technology? First of all, it reduces the amount of work related to customer service. Fewer misdirected transfers mean fewer complaints and refund requests. Secondly, it assures additional income by providing a new service. And finally, choosing the OCR technology builds a positive image of the financial institution among entrepreneurs through the provision of a useful tool for improving transfers execution.

Customers who choose the mobile banking application do not want to be constrained in any way. They want to carry out transactions with one finger, here and now, while maintaining a high level of security, without the risk of making a mistake when ordering a transfer. Throughout the years, banks have earned the trust of their customers and a technology such as OCR will undoubtedly help them preserve that confidence.