What does the integration with the Huawei system consist of and should banks go this way?

Do banks create mobile applications for Huawei phones?

They do. Several banks already provide applications for HarmonyOS (i.e. Huawei’s mobile system) that can be downloaded to the latest Huawei phones. Among them are: Spain’s BBVA, Chile’s Santander, France’s Boursorama Banque, Turkey’s QNB and Poland’s IKO and mBank. The list is not overly long but it proves that, despite its setbacks, the company is not overlooked by banks.

Huawei has not had an easy time recently. Mainly because it lost access to Google Media Services (GMS). Why is this a problem?

Smartphones that have access to GMS can run such flagship applications from Google as Maps, Pay, Drive, Gmail, Calendar or Play Store etc. Especially the last one is important because it enables the user to install different applications from all over the world.

A massive blow to the banking applications is the unavailability of contactless payments and maps, the latter of which can be used to locate the nearest ATMs or bank branches.

Two models of developing applications for Huawei

The banks that wish to make their applications available via AppGallery (Play Store made by Huawei) can choose between two ways.

1. BASIC

The first of them is to deliver the app in a more basic version without any access to Google Media Services or Huawei Media Services (more about them later in the article). This option does not require too much development work and after a relatively short time the application is available to the users.

2. FULL

The other method is the integration with the Huawei Media Services (HMS) ecosystem. This process is longer and more complex but eventually results in a fully functional application with access to all services, such as notifications, geolocation and contactless payments.

The most common path chosen by companies is fast submission of the basic version to Huawei’s store, so that users can become familiar with the application or start using it. At the same time, work is being carried out on the integration and expansion of the application in order to deliver a fully-fledged program in the future.

(It is estimated that most smartphone users possess older devices that still have access to GMS. Therefore, they do not use AppGallery as the main application source and work mainly on Play Store applications.)

Mobile banking on Huawei

More and more banks are deciding to provide Huawei users with their application. Most of these applications are provided only in the basic version, without HMS integration.

The lack of access to push notifications or maps limits some of the functionalities but it does not block the applications themselves. Bank customers can check their balance, account record and make transfers, but contactless payments are severely hampered. Although Huawei offers its genuine Huawei Pay system powered by UnionPay, it only supports cards issued by a few banks.

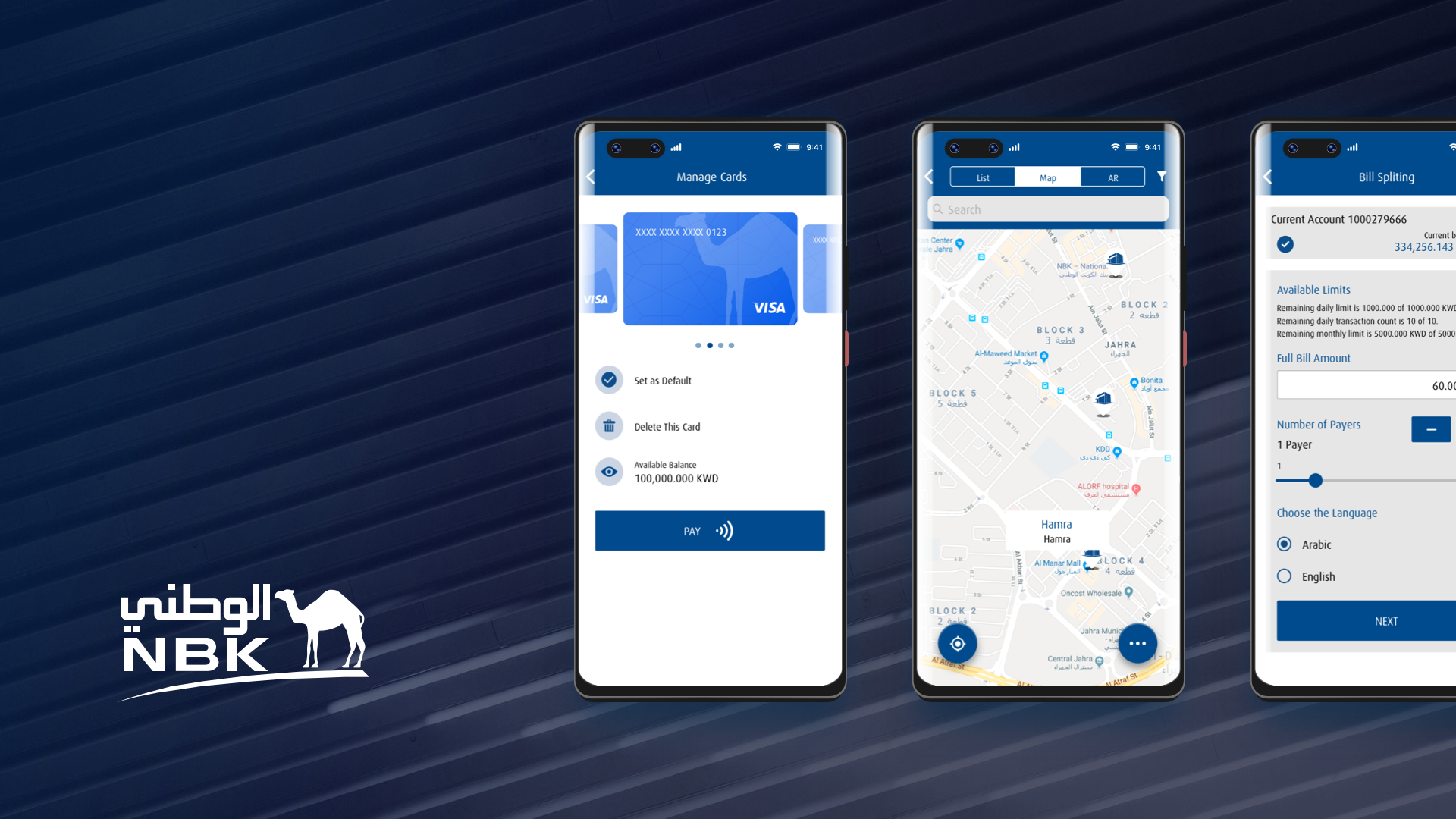

NBK Mobile Banking App in AppGallery

FINANTEQ has adapted the National Bank of Kuwait (NBK) Mobile Banking App to the Huawei platform. In order to fully optimize the work, the process was divided into two stages. The first of them covered:

- NBK Android application enhancement to AppGallery store;

- NBK Android application enhancement in terms of switching off maps, push notifications – to have no impact on the app users;

- Full regression tests;

- Delivering version ready to deploy to the AppGallery;

- Support in terms of creating AppGallery account and application upload.

The entire operation went very smoothly and closed in about 14 days. The second stage involves integration with HMS and providing the users with further functionalities. The first of them to be available to the NBK Customers will be the NBK Push Notifications in the App.

Changes at the top

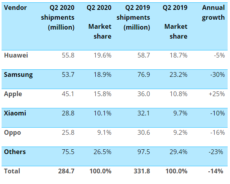

Samsung and Apple have dominated the telecommunication market for many years. The latest reports show that a new, significant force has emerged – Huawei. In a worldwide ranking of phones sold this year Huawei outstripped the Korean giant. 55.8 million Huawei phones (19.6% of the market) were sold in the second quarter of 2020. Samsung came second with 53.7 million (18.9%) sold devices. Apple closes the podium with 45.1 million (15.8%) devices.

The Chinese giant aspired to be the global market leader already in 2019. However, its inclusion in the black list and the cutting off Chinese companies from American technologies by Donald Trump (including the critical for smartphones Google services) cooled customer interest in Huawei phones. Notwithstanding the difficulties, the company has found a remedy.

Ban on GMS and what is next?

Despite its latest models being cut off from Google Media Services, the Chinese concern did not give up but started to work intensively on the development of its own ecosystem Huawei Media Services (HMS). Huawei also offers HarmonyOS, a multi-platform open-source system available for “smart screen” devices. According to Richard Yu, CEO of Huawei’s Consumer Business Group, HarmonyOS is intended to allow for easy implementation of a once created application on other devices.

Applications adapted for the Huawei system are available in AppGallery. According to The Register in July 2020 the store offered around 81 million products targeted mainly at western markets. Currently, the figure is already over 96 million.

Only 10% of the 700 million users of HMS Core and AppGallery live in Europe. This shows the long way the company has yet to go to conquer the global market.

To sum it up

Will Huawei regain its position?

The brand has been actively encouraging European developers to create applications for the Huawei ecosystem. In order to win over companies (including banks), a system of subsidies worth 1 billion dollars has been created to nurture and support application developers in the West in their creation of Huawei mobile services.

We are yet to see the outcome of this.