Mobile shopping done as part of the bank application is gaining popularity. At the beginning, it was only an interesting trend, but it turned out to be a useful feature which helps clients in everyday life.

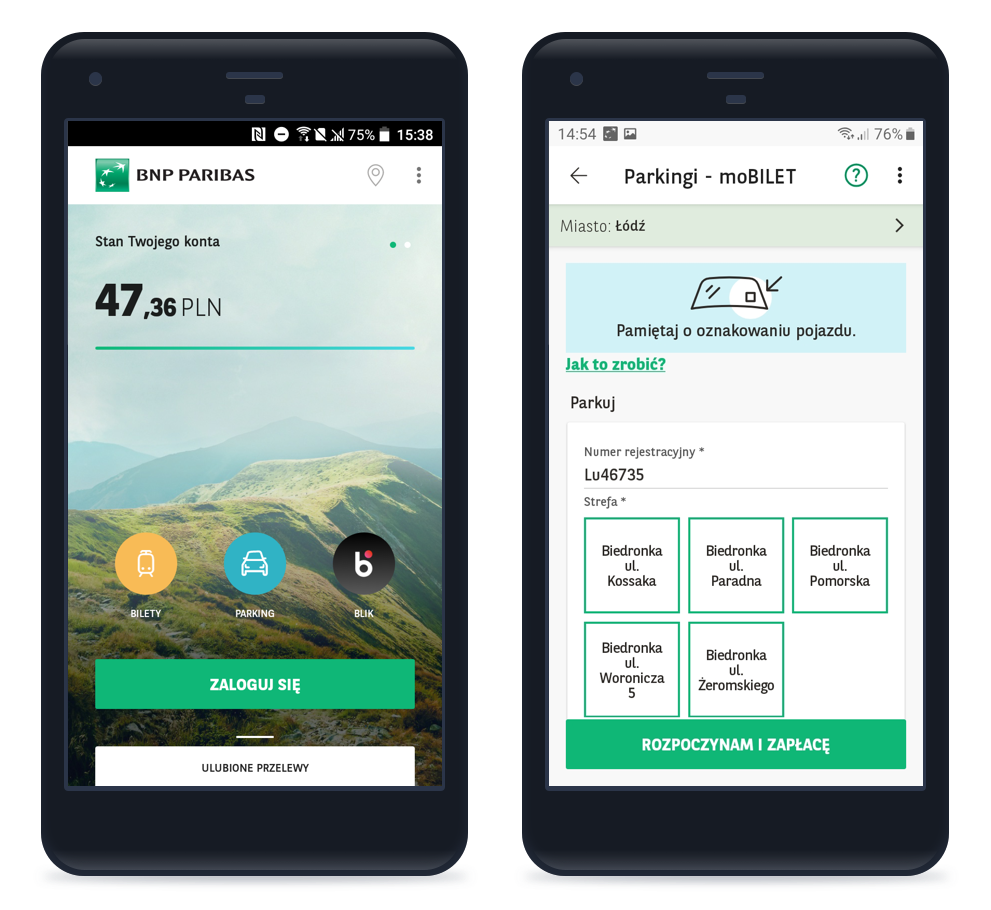

A few months ago BNP Paribas Bank Polska SA announced the refreshing of its mobile application. Among the implemented changes one will find SuperWallet, which is a solution from the m-commerce area prepared by FINANTEQ. It enabled the appearance of the module of the purchase of public transport tickets (in almost 100 cities throughout Poland) and parking tickets in the application.

SuperWallet is a platform that enables banks to provide additional services for clients via their mobile application. The platform enables not only buying tickets and paying for parking places but also getting taxis, ordering flowers or buying tickets for cultural and sports events.

So far, the largest Polish banks, such as Santander Bank, BNP Paribas and dynamically developing Nest Bank have chosen the FINANTEQ module. Similar solutions (not supported by the SuperWallet module) are also used in the application of Millennium Bank and PKO PB. ING Bank Śląski has also announced the implementation of the shopping application.

Raiffeisen Polbank, which does not exist now, was one of the banks which independently implemented the ticket purchase module based on the moBilet application engine. Interestingly, BNP Paribas did not retain this module upon the acquisition of Raiffeisen in 2019. Upon the merger of the banks, the online and mobile banking systems were harmonised, and the mobile shopping of Raiffeisen was replaced by the FINANTEQ solution.

The growing popularity of the service among clients shows that it meets their needs precisely. Therefore, it can be an element that has a real impact on the client’s decision regarding the choice of the bank.

The revolution for which we had to wait

Santander Bank Polska was the first bank that implemented SuperWallet. Making these transactions would be impossible without the cooperation between FINANTEQ and partners offering particular services. In the case of purchasing tickets and paying parking fees, the partner of FINANTEQ is moBiLET; in the case of getting taxis – iTaxi, in the case of purchasing flowers – Poczta Kwiatowa, and in the case of purchasing tickets for events – Bilety24.

Both parties benefit from such an ‘alliance’. The bank has a new opportunity to involve users, and the partner receives access to a multimillion client base, i.e. the bank’s clients. At the end of each day both parties share their profits.

At this point, it might be worth to mention the example of moBiLET. In Q2 of 2019 the application was used to purchase tickets with the value exceeding PLN 10 million, and moBiLET left behind its competitors in this field.

According to the Cashless portal, cooperation with banks (both as part of the cooperation with FINANTEQ and its own contracts concluded by the operator) has an undeniable impact on this increase.

More than money management

What is the most important issue during the mobile shopping implementation? First of all, it is time – the one who meets the clients’ needs more quickly and gives them something which their competitors do not have wins. Faster implementation of the service translates into increase in acquired clients and reduction of the loss of existing clients.

Banks can implement the virtual wallet into their application in two ways. The first option is based on direct contact and integration with the service provider. In this case, it is hard to talk about saving time and money; it is a higher cost of implementation related to the maintenance of the team, tools and extension of an additional module for a financial institution.

The second option, which ensures the fastest implementation, is the solution in the form of a ready platform adjusted to added services, such as SuperWallet from FINANTEQ. For the bank, this means in particular:

- faster entry into the market with the new set of services,

- the finished product in the form of SDK (Software Development Kit),thanks to which it does not have to create a module from scratch,

- reduction of TCO (Total Cost of Ownership), which helps to avoid the excessive costs of a server, additional equipment, modifications or hiring new employees and

- a database of proven partners offering specific services.

The bank can implement SuperWallet as a full service package (as Santander Polska and Nest Bank have done) or a set of particular functionalities. At this point, it is worth to mention the example of BNP Paribas Bank Polska which focused on purchasing tickets and paying parking fees.

M-commerce – a new standard in Polish banking

SuperWallet was a revolutionary solution at the time of its creation. Its innovativeness was appreciated mainly in the Finovate competition and in the Citi Mobile Challenge EMEA competition, where it won the title of Top Innovator. However, even though it was awarded and recognised in the industry, it had to wait patiently for banks to appreciate it and for the moment when banks started looking for an additional value which they can offer to their clients along with mobile banking. The patience paid off. Today, establishing cooperation between banks and e-commerce service providers has become not only a reality but, above all, a standard which clients want and expect.

M-commerce in mobile banking is a trend which cannot be ignored. This has been confirmed by the latest PayPal report. According to this document, regardless of the age group, almost 80% of the respondents made purchases in the last 6 months via their smartphone. At the same time, only two thirds of companies are prepared for this huge increase. Enriching the mobile banking application with the m-commerce module is an excellent solution in such a situation.