In today’s ever-evolving financial environment, the push for sustainability is more than a trend—it’s a profound journey. Imagine a world where every banking decision not only drives profit but also nurtures our planet and society.

This is the story of how ESG principles have transformed banking operations, setting the stage for a green revolution in finance.

The ESG Odyssey: Embedding Sustainable Principles

The journey began when financial institutions recognized that Environmental, Social, and Governance (ESG) principles were no longer just add-ons but vital drivers of long-term success. Banks have shifted from viewing ESG as a regulatory checkbox to embracing it as the heartbeat of their operations. By weaving sustainable practices into their core strategies, these institutions now address not only the demands of stakeholders but also the growing need for responsible growth.

As the story unfolds, banks are reimagining traditional models by integrating ESG factors into every facet of their business—from risk management to customer engagement. This commitment is seen in innovative green loans designed to fuel renewable energy projects and carbon footprint calculators that empower customers to see the real impact of their financial choices.

Empowering Change: Tools for a Sustainable Era

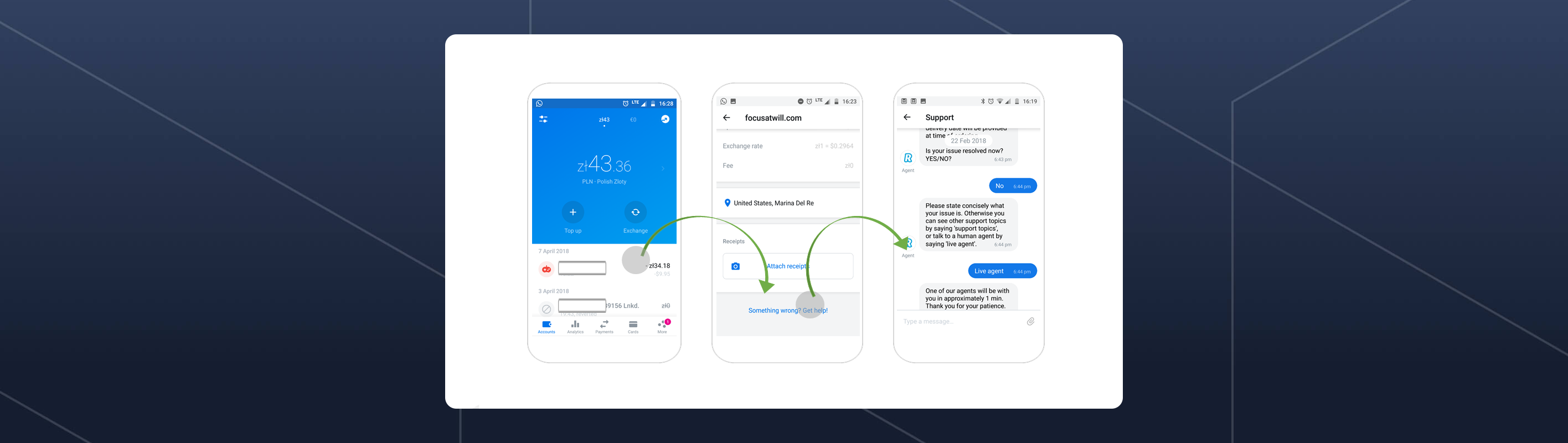

Consider a customer who logs into their banking app and finds a personalized dashboard showing their carbon footprint. With a few taps, they receive actionable insights on how to reduce their environmental impact. Tools like these are transforming banking into a partner in sustainability, bridging the gap between financial health and environmental responsibility.

Green loans, too, are at the forefront of this transformation. These specialized products not only offer favourable terms to those investing in clean energy or energy efficiency improvements but also symbolize a bank’s commitment to a low-carbon future. Each loan becomes a stepping stone towards a greener economy, fostering innovation and creating new market opportunities for both the bank and its customers.

Navigating the Challenges: Reporting, Integration, and Expectations

The path to sustainability isn’t without obstacles. As banks strive to report ESG metrics transparently, they confront challenges in data collection, quality management, and standardization. The narrative here is one of perseverance—banks are developing strong systems and embracing recognized reporting standards to overcome these obstacles.

Moreover, balancing short-term profitability with long-term sustainability goals requires a cultural shift. Financial institutions are learning to adjust credit risk models and incentive structures, ensuring that both employees and leadership are aligned with this transformative vision. In an era where clients demand socially responsible practices, maintaining trust through clear communication and genuine commitment is more critical than ever.

The Quiet Revolution: AI Accelerates the Green Transition

After laying a solid foundation in ESG, banks are now turning to advanced technologies to take sustainability even further. Artificial Intelligence (AI) is emerging as a quiet revolution behind the scenes, offering powerful tools to analyze environmental risks and optimize resource allocation.

AI-driven analytics provide banks with deeper insights into a company’s carbon footprint and sustainability practices. This enables more informed investment decisions and the creation of tailored green financial products. Imagine AI algorithms that not only predict environmental risks but also suggest the most efficient ways to reduce emissions across entire supply chains. With predictive modelling and advanced analytics, AI is transforming logistics, enhancing transparency, and identifying opportunities for sustainable sourcing.

By harnessing AI, banks are not just keeping up with the change—they are leading it. The integration of AI into sustainable finance marks the next chapter in our story, where technology and ESG principles unite to create a resilient and forward-thinking financial ecosystem.

Conclusion: Charting a Sustainable Course

The green banking revolution is more than a narrative of technological innovation; it’s a story of transformation. As financial institutions embed ESG principles into their DNA, they pave the way for a future where profitability and responsibility go hand in hand. From empowering customers with real-time insights to overcoming the challenges of reporting and integration, every step taken is a testament to the commitment of the banking world toward a sustainable future.

In this journey, AI stands as the catalyst that accelerates change, ensuring that the path to sustainability is not only achievable but also enriched with innovative solutions. The future of banking is green, and every decision made today is a new chapter in the story of sustainable finance.