Development

Published on:

November 13, 2025

In an era of instant payments, smart chatbots, and sleek mobile apps, it’s hard to believe that the backbone of global banking still runs on technology from the 1970s and 1980s.

Despite the fintech boom and growing customer expectations, institutions continue to rely on legacy systems to process the bulk of financial transactions.Many banks today face a strategic dilemma: should they modernize, integrate, or rebuild their technological core from scratch?

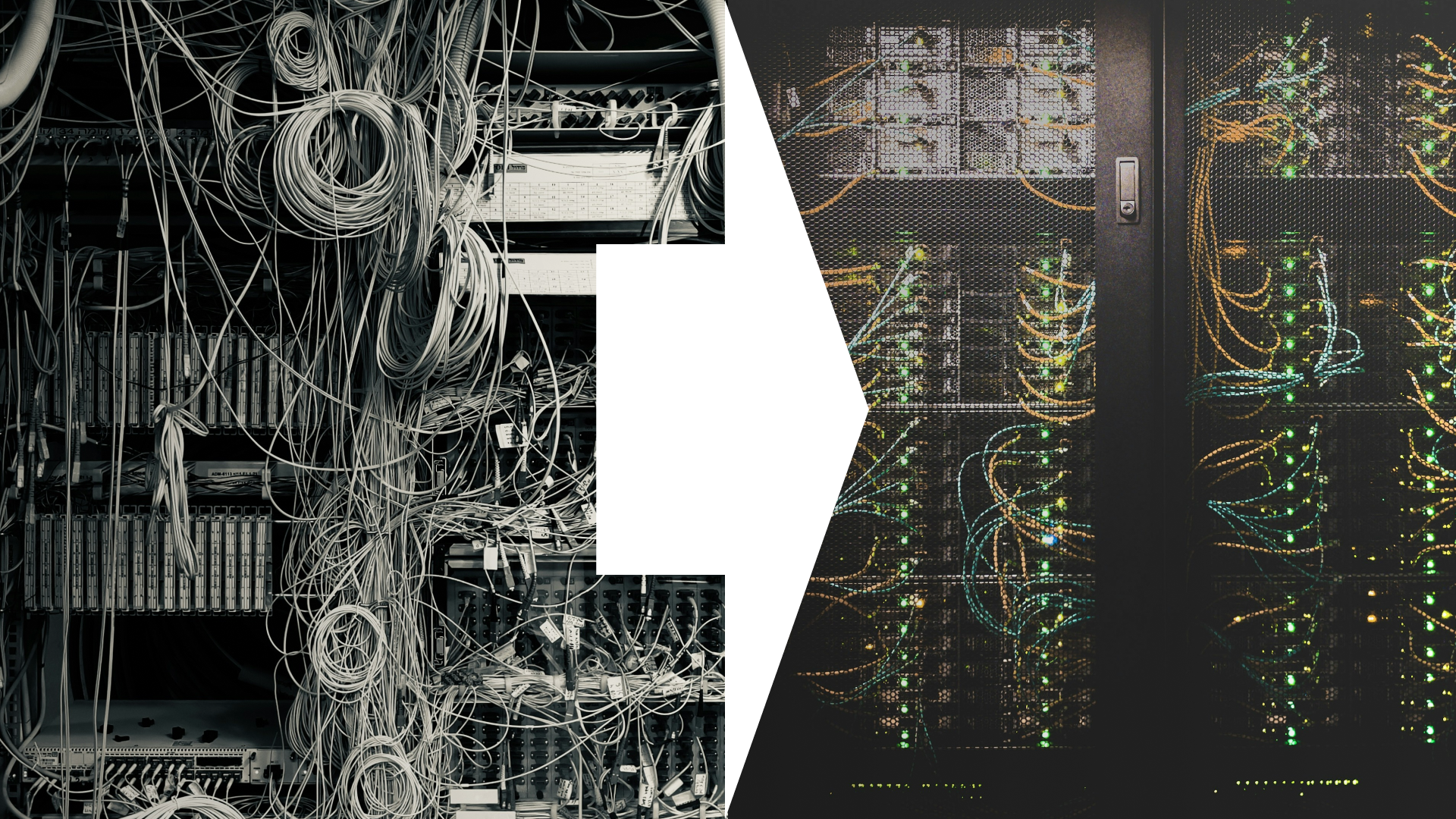

Legacy systems have survived in banking for decades for one main reason – they still work. Despite being built on outdated programming languages and architectures from half a century ago, they offer exceptional stability and reliability. They operate continuously, processing millions of transactions every day, often without a single interruption. For institutions whose reputation depends on trust and security, that consistency is invaluable.It’s also important to recognize that, over the years, a dense web of dependencies has formed around these systems. Dozens of applications, modules, and business processes are tightly connected to them, meaning that changing one component can trigger a chain reaction throughout the entire IT ecosystem. Moreover, the knowledge of how these systems truly function often resides in the minds of a few experienced specialists nearing retirement. When they leave, their expertise goes with them creating a serious knowledge gap that’s difficult to fill.The paradox is clear: what was once a symbol of technological innovation has now become an obstacle to progress. Banks are fully aware of this, yet the decision to modernize is far from simple.

Migrating from legacy systems is far more complex than simply replacing old technology. It’s a transformation that affects the entire organization and requires balancing technology, people, and processes, making modernization one of the most demanding undertakings in the financial sector.Banks that decide to modernize quickly discover that the biggest challenge isn’t adopting new tools, but understanding how deeply interconnected their existing systems are. A lack of comprehensive dependency mapping, concerns about regulatory compliance, and attachment to long-standing processes often slow transformation efforts.

Modernization therefore demands not just technological ambition but also strategic foresight and flawfless cooperation across the entire organisation. The key lies in finding the right balance between the speed of change and operational security, recognizing that success comes not from revolution, but from controlled evolution.

Transforming banking systems doesn’t have to mean tearing everything down and starting over. Increasingly, institutions are embracing an approach where modern solutions are introduced gradually, creating a flexible and scalable architecture that allows the “old” and the “new” to coexist. This approach reduces risk while accelerating innovation and improving adaptability.

This evolutionary, modular, and integration-driven approach is becoming the dominant model in modern banking. It allows institutions to maintain operational stability while opening the door to innovation and new business models. As a result, modernization is no longer a one-time project. It has become a continuous process of adaptation to an ever-changing technological and regulatory landscape.

FINANTEQ specializes in developing banking applications. Thanks to our experience in integrating new solutions with existing systems, we are able to identify critical dependencies, map business processes, and pinpoint areas where modernization can deliver the greatest benefits with minimal risk. Collaborating with us allows banks to implement new modules and digital layers in phases, while maintaining the stability of their operational core.By developing and deploying solutions for our clients, we can also monitor compliance with regulations and security standards, ensuring that migrations proceed smoothly and that banks can fully leverage the potential of modern technologies without interrupting day-to-day operations.Learn more about how we work here.

Migrating from legacy systems is not a sprint but rather a marathon filled with technical, organizational, and cultural hurdles. Banks that attempt a “big bang” replacement often face delays and ballooning costs. The winners are those who embrace evolution over revolution: combining the stability of proven systems with the agility of new technologies. In practice, that means: understand your system, plan your path, modernize gradually. Because in banking - as in finance - caution and precision remain the best investment.