From tracking the card location to “drunk mode” — banks can use all sorts of ways to protect the customer’s payments. All thanks to mobile apps.

It was the middle of the night. Suddenly the phone rang. The caller asked ina calm voice: — “Are you currently in Florida buying donuts?”. Andrzej, just woken up by the ring, denied and responded he was in his bed, in eastern Poland. Indeed, he was in the US a month before, but he already came back home safe and sound.

The situation was clear — someone had copied Andrzej’s card and now the fraudster was enjoying free shopping (at Andrzej’s expense). A bank consultant (he was the one who called in the middle of the night) immediately blocked Andrzej’s card.

The above story is quite a typical scenario — European visitors to the US often have their payment card’s magnetic stripe copied and their money stolen. How do I know? I was there too — on that business trip — with Andrzej. My bank contacted me about the same issue sometime later.

When a card meets mobile banking

There are situations (like this business trip) when it is advisable to increase the level of card security. The bank’s mobile application comes in handy here. Here is a short review of what different banks do about it around the world.

Revolut — tracks the location of the card

Have you noticed that you always take two things with you when leaving home? Your wallet (with the cards inside) and the mobile (with the bank’s application). These two are inseparable.

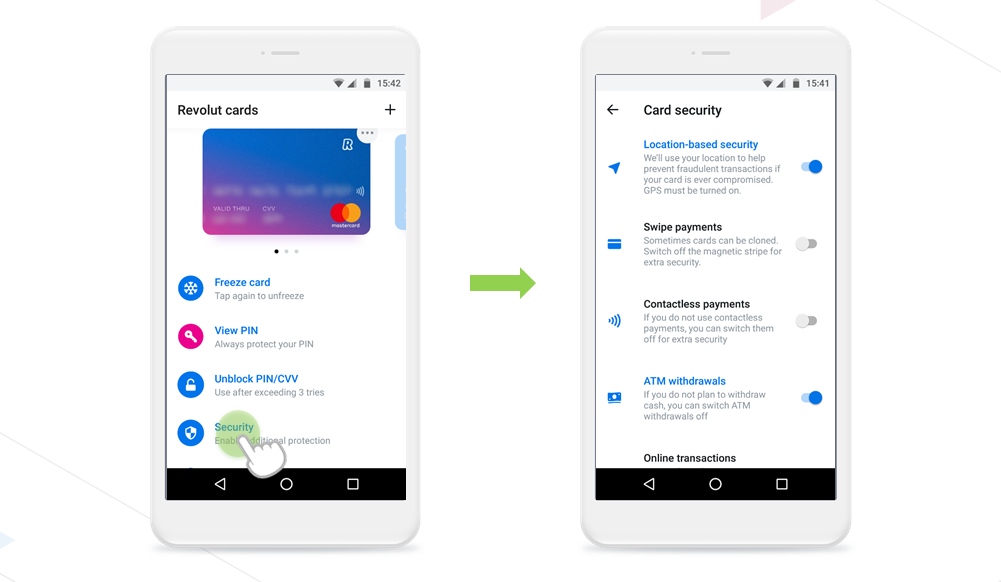

Revolut is well known for its innovative approach to customer service.This is how Revolut uses this insight to protect its customers’ cards:

Location Security: Once you turn this feature on in the app, we will use your phone’s GPS location to determine if your card has been compromised and help prevent fraudulent transactions. For example, if your phone and you are in Germany and a transaction is attempted in Hong Kong with your card details – we will stop the transaction from going through.”

Quick replies

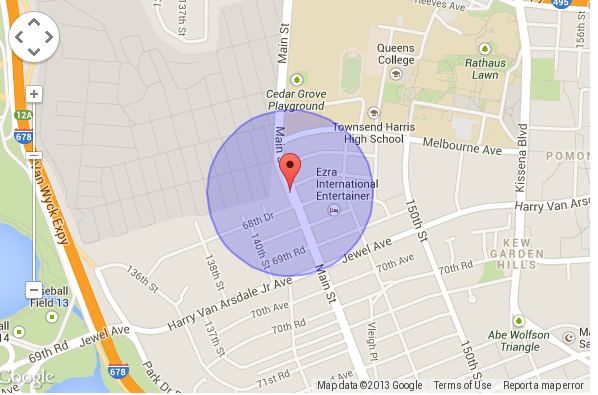

Seems a very useful feature when you travel. Please note, that this is not a solution for every customer (not everyone will let the bank follow them). Reassuringly, the banks say it is not about very precise location, but rather the area within a 20-kilometer radius of the phone.

Location Security is not all. To avoid unauthorized purchases, Revolut cardholders can also disable online shopping (which I did before posting my card picture in this article), block ATM withdrawals and contactless payments (or turn them on instantly when required).

Ally Bank — Nike yes, Puma no

Let’s put travel abroad aside. What if a bank customer has a gambling problem and is consciously trying to cut down on it? The help comes from the British Starling Bank, whose application enables blocking transactions of this type and a few others. (In the UK, 1% citizens admit to a gambling addiction, so offering them a helping hand is an element of bolstering the bank’s image.)

Ally Bank goes even further. The application allows its customers to enable or disable specific categories of merchants, such as groceries, fuel, entertainment, plane tickets or hotel fees, to control card usage. The use case which comes to my mind here is, for example, preventing a child (for which we’ve set up the first bank account) from buying virtual artifacts e.g. in Fortnite.

How do the banks know which transactions to block? At Starling, the transaction codes that allow the bank to categorize customer spending are the same ones that allow Starling Bank to identify gambling establishments.

Monzo — Drunk mode

Another British bank and another inspiring idea. You can’t control your expenses on a Friday night out? Use the Monzo’s drunk mode and set a limit for the night, beyond which the card is blocked for some time. As far as I know, the idea has never been implemented though — it was proposed on Monzo community forum (which is BTW real implementation of Monzo tone of voice guidelines).

Following Monzo’s and Starling’s examples, maybe some bank would like to implement the “never-spend-money-foolishly” functionality? With a drag of a slider we could block all transactions related to gambling and buying alcohol as well as ATMs in close radius to go-go bars.

Do we need cards?

Blocking a lost or stolen card individually by the user or setting a monthly or even weekly spending limits manually have become standard practice in banking apps today.

Obviously, there are a lot more options for managing cards. For instance, the Polish mBank enables temporary card blocking (ideal for a visit to the gym, where you can leave your card in a locker without bothering later with unblocking the card).

The question is though: is it all necessary? Maybe instead of “repairing” the cards by means of mobile banking, give up on carrying them altogether? Switch to NFC, pay via an app and leave all cards at home (for security reasons)? But that’s a whole different story.

Follow FINANTEQ Insights!

Receive our analysis about innovations from the world of mobile banking and mobile fintech. Sign up for free!